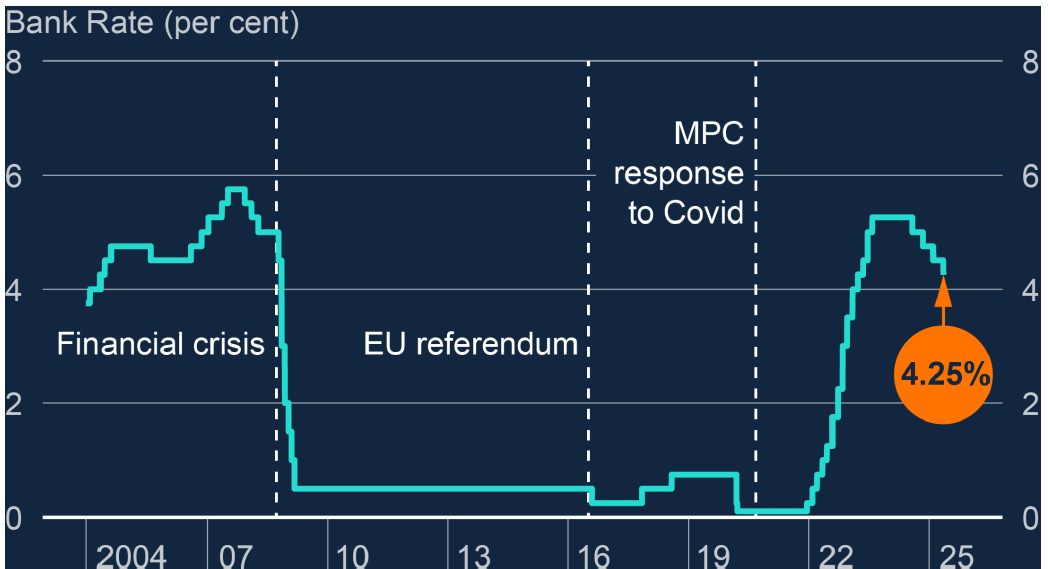

Bank of England cuts base rate to 4.25%

Another Bank of England monetary policy committee meeting, another base rate cut.

The decision, which was widely expected with the financial markets pricing in a 95% chance of a reduction, whereas before ‘Liberation Day’ it was looking more like 50/50.

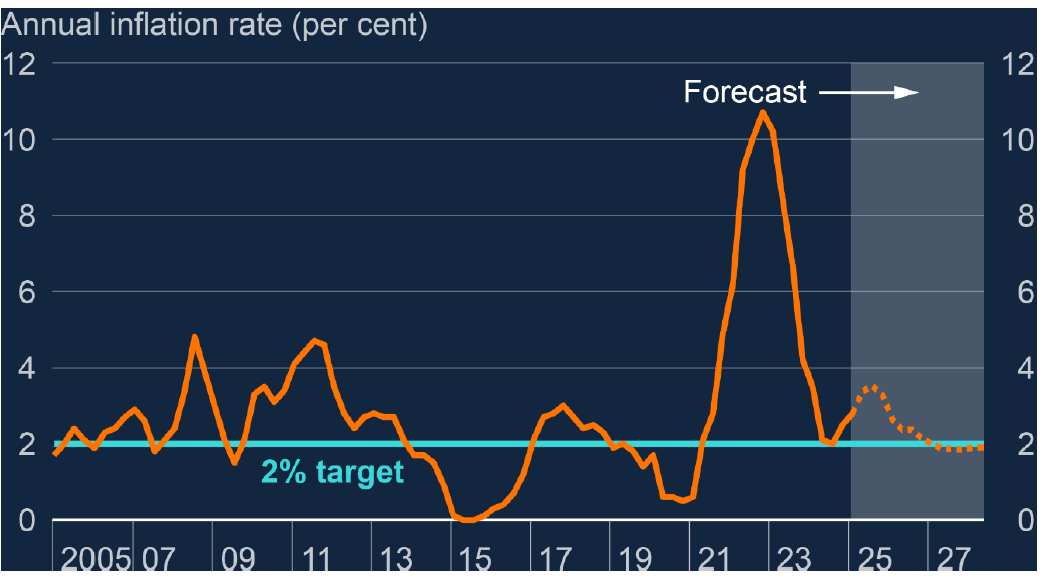

This was due to lower-than-expected inflation in March, to 2.6%, down from 2.8% the previous month and below the 2.7% that economists had been expecting.

The drop to the base rate today follows several months of a gradual and careful approach to alternate 0.25% cuts that started back in August last year.

It’s the fourth time rates have fallen in a year, the lowest rate since May 2023, and the fastest pace of cuts since the financial crisis of 2008-09.

The MPC voted by a majority of 5–4 to reduce the Bank Rate by 0.25 percentage points, to 4.25%. Although

Although the current impact of the global trade news should not be overstated, the news was sufficient for those members to judge that a reduction in Bank Rate was warranted. Two members thought this month’s cuts didn’t go far enough, preferring to reduce the Bank Rate by 0.5 percentage points, to 4%, with the other two members preferring to maintain the Bank Rate at 4.5%.

Catherine Mann and Huw Pill were the two members who preferred to hold the Bank Rate at 4.5%, recognising that short-end market interest rates had already eased by around 40 basis points since the MPC’s previous meeting. The Bank’s governor Andrew Bailey began his news conference by saying cutting rates was in part due to inflation being lower than expected in March, but warned inflation will increase temporarily later this year to 3.7%, largely due to higher energy prices before returning to the 2% target. Inflation has been close to the 2% target since the middle of last year, with The Bank of England using the base rate as a way of taming inflation from a peak of over 11% in 2022.

The Bank of England increased the base rate fourteen times in a row from 0.1% in late 2021, to 5.25% in August 2023. It then cut the rate twice last year, first in August, again in November and then again in February this year. The Bank of England has said “If things evolve as expected, we expect to reduce interest rates further, but there are risks around the path of inflation.

We will continue to assess different possibilities carefully.” Uncertainty is a word that’s come up a lot following the latest rate decision.

With the committee’s vote split three ways, even the Bank’s governor said he was undecided in the run-up to the latest vote.

It signals uncertainty in the future path of interest rates and this uncertainty also abounds in the UK and global economy, despite progress on a US-UK trade deal. Leading industry body the Confederation of British Industry says the Bank of England could be more cautious on rate cuts this year because of the uncertainty caused by President Trump's trade tariffs. Bailey warned " the past few weeks have shown how unpredictable the global economy can be" following the introduction of worldwide tariffs by President Trump.

Because of this, monetary policy is not on a pre-set path and The MPC will remain sensitive to heightened unpredictability in the economic environment and will continue to update its assessment of risks.

Based on the Committee’s evolving view of the medium-term outlook for inflation, a gradual and careful approach to the further withdrawal of monetary policy restraint seems likely to continue.

What does this mean for household finances and the property market? Firstly, as a result of the base rate dropping today, the nearly 600,000 homeowners who are on tracker deals will typically see their monthly repayments fall by about £29, according to figures from banking trade body UK Finance and those on standard variable deals must wait to see how their lender responds.

However, the vast majority of mortgage-holders have fixed deals and their rate only changes when they renew a deal, usually after two or five years.

Financial markets are expecting further cuts from the Bank of England, which would bring the base rate down to 3.75% by the end of the year.

This should ensure the cost of an average fixed-rate mortgage remains in the 4-5% range.

Previous base rate drops have clearly had a positive impact on market activity, resulting in more positive consumer confidence as new listings entering the market, sales agreed, buyer demand, mortgage approvals, and transaction levels have all increased since The Bank of England started cutting rates last August.

The latest Barclays Property Insights data shows rent and mortgage spending increased 5.2% year-on-year in April, but is down slightly from 5.4% in March, as many lenders reduced mortgage rates. Confidence in household finances remained consistent month-on-month at 70%, while many UK homeowners are taking prudent steps to decrease their mortgage term through overpayments. Confidence in the UK housing market remained in-line with March 2025 at 29%, amid speculation that the Bank of England would cut the Base Rate on 8th May and mortgage rates would drop further. While research conducted between 18th-22nd April showed that interest rates remained concerning for consumers, this decreased slightly to 61%, from 63% in March. In an effort to reduce the impact of interest payments on home loans, almost one in four (23%) mortgage holders are actively making overpayments. These additional payments average £221 per month on top of their regular repayments, or £2,647 per year, with over-payers predicting this will reduce their mortgage term by four years on average.

Despite recent increases to stamp duty thresholds impacting the cost of buying, renters’ confidence in their ability to own a home within five years recovered slightly in April. A fifth (20%) cited it as a possibility, compared to 15% in March.

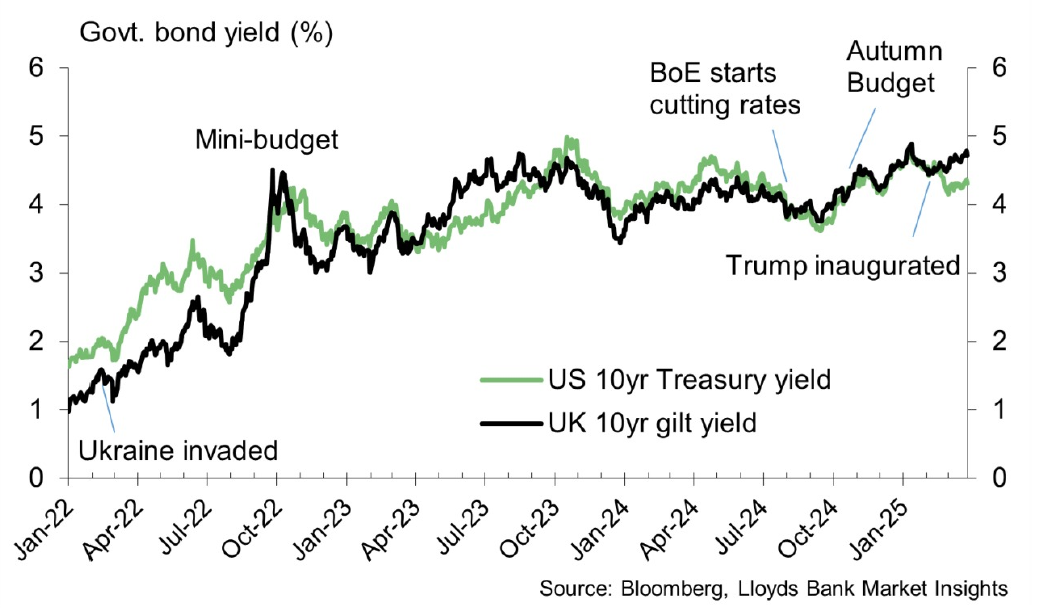

The proportion of renters who see obtaining a mortgage as a barrier to owning a home also fell (18% vs 21% in March), following several high street lenders dropping their mortgage rates last month. The rise in confidence correlates with an uplift in renters saving for a deposit to buy a home, with almost three in ten (27% doing so in April, compared to just over two in 10 (22%) in March. What is actually happening to interest rates? Despite most commentators expecting more base rate reductions this year, over a third of the public expect mortgage costs are likely to rise. HomeOwners Alliance surveyed 2,000 UK adults and found 37% expect mortgage rates to go up over the next 12 months, 16% think they will go down, 25% believe they will remain steady, and 22% didn’t know. This is most probably due to the economic anxiety and confusion as to what’s potentially coming next, highlighting just how fragile confidence is due to continued uncertainty. The ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages increased by 2 basis points, to 4.53% in February and the rate on the outstanding stock of mortgages was 3.87% in February, up from 3.81% in January. UK gilt yields have moderated following a period of volatility at the start of April with the 10-year gilt yield falling to around 4.50% and down from a peak of 4.75% earlier in the month, while the 30-year yield has also eased having previously hit its highest level since 1998.

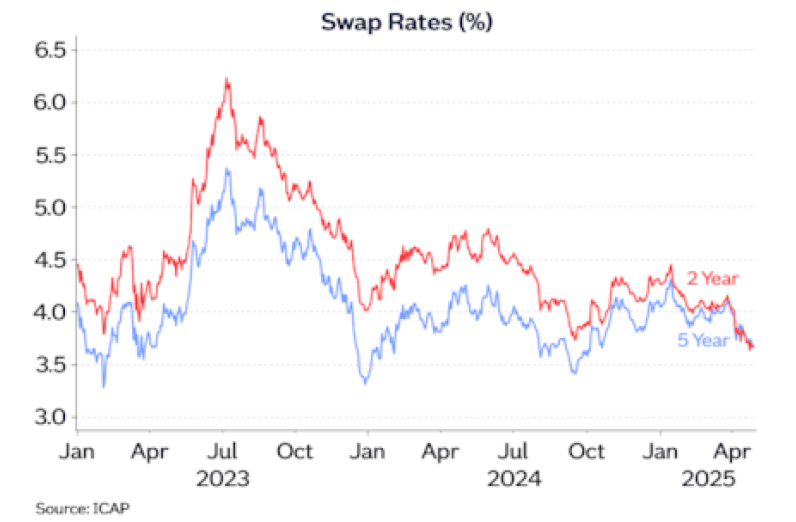

As of early May 2025, UK swap rates have been on a downward trend, reflecting market expectations of imminent base rate cuts by the Bank of England (BoE).

The average two-year fixed rate mortgage is currently 4.64%, down 0.77% on a year ago and the five-year option is 4.60%, down 0.41% on last year.

The lowest rate with a two-year fix at 3.72% is 0.89% lower than a year ago and the five-year rate at 3.78% is 0.38% lower than last year.

Barclays, HSBC and NatWest have all joined the other big six lenders in Halifax, Nationwide and Santander in offering fixed rates below 4%. The gap between the average two-year fixed rates and five-year fixed rates is closing, with the average two-year fixed mortgage rate for those with a 40% deposit now cheaper than the average five-year fixed equivalent and the first time this has happened since the mini-Budget. The average two-year fixed, 60% loan-to-value (LTV) mortgage rate is now 4.18%, while the five-year equivalent is 4.19%. This reflects the growing trend that it’s becoming cheaper for lenders to price shorter-term rather than longer-term deals, with the global tariffs situation likely accelerating this.

Zoopla believes an emerging trend that will positively support market activity in the coming months will be a relaxation in how lenders assess the affordability of new mortgages.

While the average 5-year fixed rate mortgage is around 4.5% today, many lenders are currently 'stress testing' affordability at 8-9% and this makes it harder to secure a mortgage without a large deposit.

If average mortgage stress rates were to return to pre-2022 levels of 6.5% to 7%, this would deliver a 15-20% boost to buying power.

This change would consequently support demand and sales volumes, helping to clear the stock of homes for sale, rather than boosting house prices.

There are now more low-deposit mortgages available to choose from than at any time since the financial crisis of 2008, according to the latest Moneyfacts UK Mortgage Trends Treasury Report.

The number of deals that need a deposit of 5% or 10% have risen to their highest level since then as reported by Moneyfacts.

For buyers able to offer a deposit of 5%, there are 442 mortgages to choose from, its highest since it reached 575 in March 2008 and two years ago, the choice was from fewer than half of that total, at 204.

Borrowers able to pay a 10% deposit now have 845 products to choose from and the highest it has been since hitting 957 in March 2008 as well.

Overall product choice rose month-on-month to 6,870 options, compared to 6,307 in April 2024 and the highest since October 2007 (7,421).

Conclusion

The decision by the Bank of England to reduce the base rate to 4.25% is a proactive step towards stabilising the UK economy, offering a much-needed boost amidst the challenges of fluctuating inflation and global uncertainties, demonstrating the Bank's commitment to supporting economic recovery and enhancing consumer confidence.

While the Monetary Policy Committee (MPC) acknowledged differing views on the pace of rate cuts, the prevailing sentiment leans towards careful yet optimistic progression.

The decision is likely to create opportunities for potential buyers, as lower base rates typically translate to more affordable mortgage options and this can invigorate the housing market, encouraging increased activity and new listings.

Lower interest rates are a clear signal for buyers and sellers alike to take advantage of improved affordability.

Historically, such adjustments have led to increased buyer interest and more dynamic market conditions, which will be particularly beneficial following the recent increase to stamp duty following the deadline at the end of March.

In summary, the base rate cut to 4.25% is a positive development that aims to boost market activity, and provide stability during uncertain times.

As the UK continues to navigate economic challenges, this decision reinforces the Bank of England’s commitment to fostering a resilient and robust financial environment, which in turn should help further support activity levels in the market and modest house price growth throughout 2025 as previously predicted.

Bank of England base rate cut

UK interest rates May 2025

4.25% base rate impact

mortgage rates 2025

property market trends UK

interest rate news UK

homebuyer confidence 2025

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link