Overview:

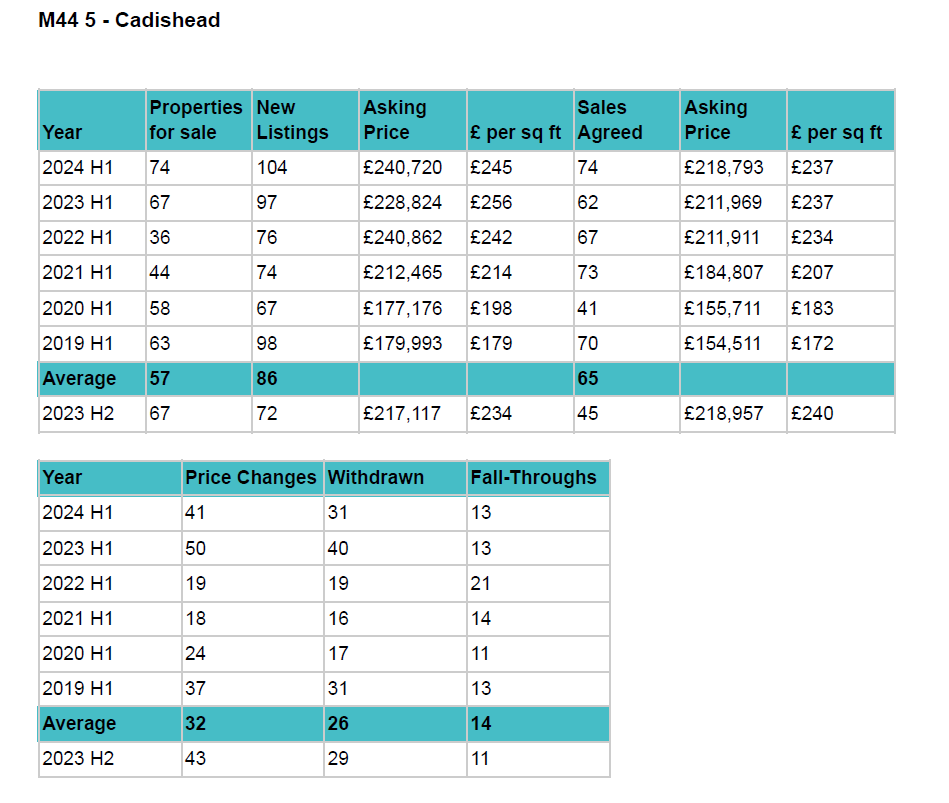

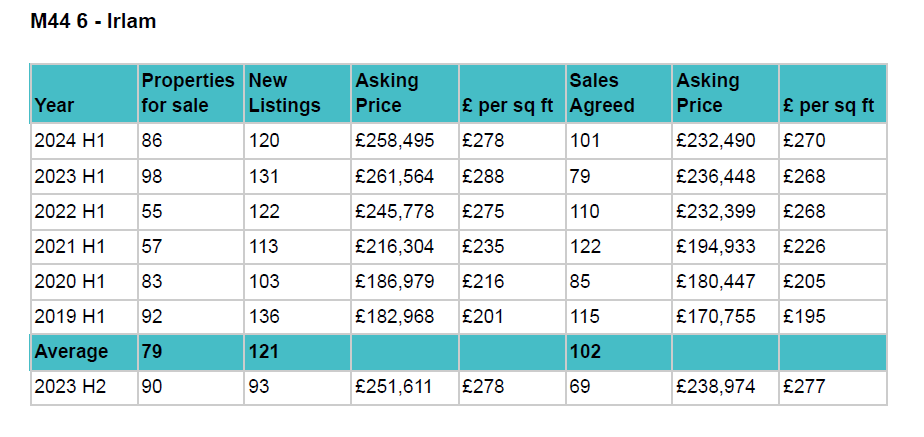

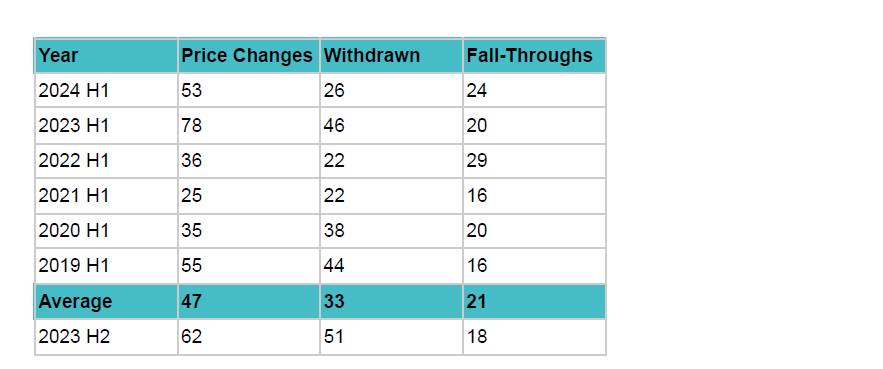

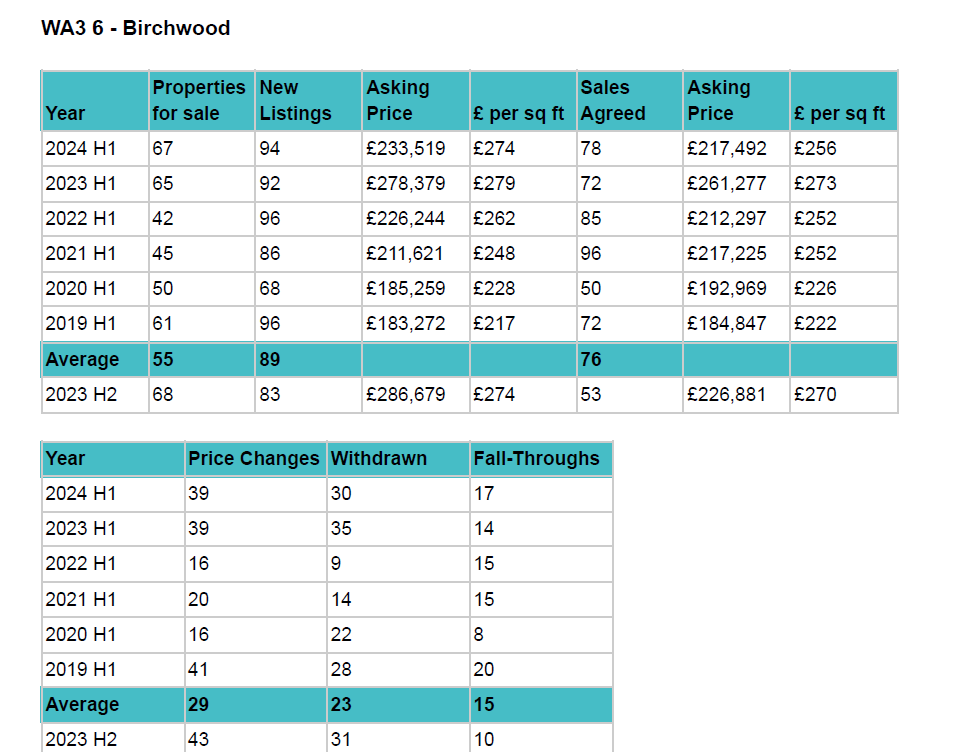

1. There is a good amount of choice for buyers and competition between sellers. The good side of this is that there is increased positivity of more properties entering the market even in the political/economic uncertain time we have seen and with higher interest rates. However, too many properties being on the market would have meant supply outstripping demand and could have caused property prices to come down.

2. As above, market conditions are clearly not putting people off from entering the market and making a move, which is a good thing as more choice will bring more

people to the market as a lot of buyers wait to find their next home before listing their own.

3. The stats above highlight how demand has continued to rise following the aftermath of the infamous mini-budget in the autumn of 2022. It’s unsurprising that the sales agreed is higher than H1/H2 2023, but the real positive thing to see is that sales agreed were still tracking the six-year average. We must remember that the average base rate in H1 between 2019-2022 was 0.6%, so to achieve the sales numbers in H1 2024 with the base rate at 5.25% is further evidence that the market is continuing to adjust to the rates of today.

Lloyds CEO Charlie Nunn says while interest rate cuts from the Bank of England expected later this year would be ‘beneficial’, homeowners shouldn’t expect a return to ultra-low interest rates. “The expectations the market have is that interest rates probably won’t get below 3.5%. And that means mortgages, or the new normal for mortgages, will be in that 3.5-4.5% range, not 1.5-2.5%.”

4. The average asking price of properties that have had sales agreed in H1 2024 is similar compared to 2023 H1. This is evidence that sellers should not get too carried away with increasing their asking prices as whilst demand is on the rise, affordability is still being stretched and buyers will not/can’t pay over the top like they were doing in the Covid market.

5. A continuing theme is properties having to reduce their asking price. Sellers must remember that reduced properties are 1.35 times less likely to sell, take

3 times as long to sell, twice as likely to have a sale fall through, and twice as likely to have to change estate agents. Anyone listing their property today must look at comprehensive evidence to support their asking price as all the data points towards pricing correctly the outset is the best thing to do. However, if a seller is in no rush, and there is a need to reduce the asking price, they need to do this in the first month of marketing and have a meaningful reduction of approx 5%.

6. There is clearly still a high number of properties leaving the market as 47.15% of properties in H1 2024 were withdrawn, but this appears to be on the way down as more sales were being agreed in H1 2024 compared to H2 2023, therefore meaning fewer properties are withdrawing as buyers have been found.

7. Fall-throughs remain the same and approx 25.12% of all sales end up falling-through. It is therefore vitally important that the correct due-diligence is done on a buyer, their finances, solicitor, and the chain are all checked thoroughly. Especially as well with the fact that the average sale is currently taking 154 days to

go through according to Rightmove. The cherry on the cake would be to work with an agent that offers reservation agreements and can reduce the fall-through rate to single figures.

In conclusion, the market is definitely in a positive place and if historic data is anything to go by and the forecasts for the near future, there might well be a bounce

following the election and a strong second half to 2024. The number of new listings and sales agreed between the election being announced and taking place were both higher than the same period in 2023 and the six-year average for this timeframe. Not only this, but the number of properties withdrawing from the market was down, fall-throughs were stable, and there was an increase in the number of sellers returning to the market. This highlights that the election has not put homemovers off in the short-term.

Mortgage approvals have remained steady or increasing for 7 months in a row now and the same can be said for transactions over the past 5 months.

The base rate has now paused 7 times in a row and on the last 3 occasions nobody has voted to increase. Inflation is at its lowest point since July 2021 and has now dropped 4 months in a row. All of this is a clear indication that the market is moving in the right direction. If you are thinking of making a move and hesitating to do so, there’s no one-size-fits-all answer to whether now is the right time to buy a home.

There’s also no way to predict precisely what the market will do in the near future. Perfectly timing the market should not be the goal. This decision should be determined by personal needs, financial means, and the time one has to find the right home. It is worth noting that those who have put off buying a home during recent times as they were holding out for price drops and lower mortgage rates have been left out of the market. Mortgage rates have stayed higher for longer than previously expected and house prices have remained stable, keeping monthly housing payments higher. In other words, affordability didn’t improve for those who chose to wait. Today's price will always feel expensive, but remember we are now eight years on from the EU referendum and house prices are on average 32.17% or £68,486 higher than before the UK voted to leave the EU. Some people might be sitting on the fence with what to do next now we have a new Government, but if the historic data is anything to go by, the UK property market continues to remain resilient throughout political and economic times, with many forecasts predicting house price growth over the next few years.

#marketreport #property #report #housingmarket #irlam #cadishead #home #estateagent #salford #manchester #marketupdate #homeforsale #sellingmyhome

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link