I hope you had a fantastic Christmas and a Happy New Year to you. I’m going to be reviewing the 2024 UK property market, how it compares to 2023 and the five-year average between 2020 and 2024. I will also be updating you on some of the most recent data on things such as Rightmove Boxing Day traffic, mortgage approvals, interest rates and predictions for 2025.

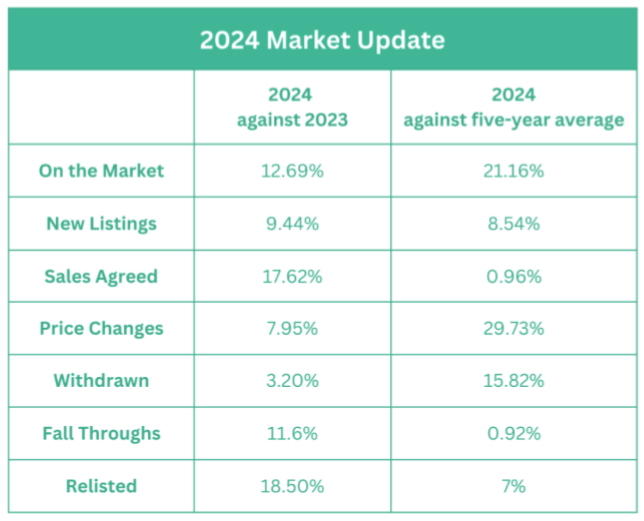

As you will see from the chart below, there was an increase in every metric when comparing the 2024 figures to both 2023 and the five-year average of 2020 to 2024. The increase in these metrics being measured has both positive and negative connotations for the property market, which I’m going to explore further throughout this article.

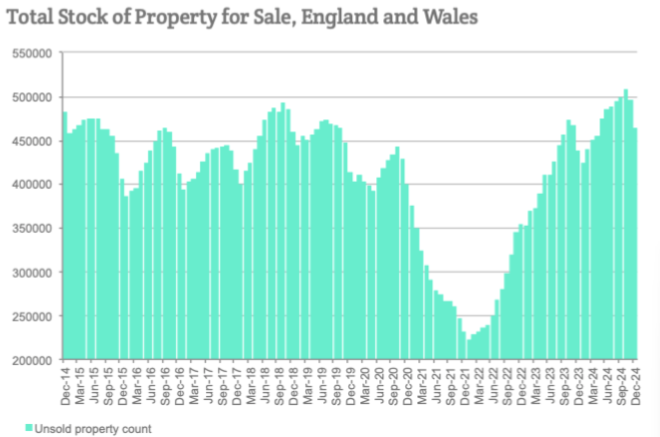

To start with in breaking this chart down, there are considerably more properties for sale versus recent years and current stock levels are sitting at a 10-year high as you will see from the graph below.

Whilst the level of unsold properties is significantly higher than in recent years, you can see from this data that there is certainly not an oversupply of property hitting the market if you review the past decade and this has stopped house prices from decreasing as there has continued to be a fine balance between supply and demand. More properties entering the market, a higher number of previous sellers trying to sell again, fewer properties selling compared to the booming market of a few years ago and those that actually sell taking longer to do so have meant the total number of unsold properties has risen; especially with the average unsold property having been on the market for 189 days.

Therefore, it is these factors above combined that have increased the unsold property count rather than just desperate sellers flooding the market as many predicted would happen throughout 2023.The positive in a higher volume of new listings coming to the market has meant more choice for buyers and in turn has resulted in more sales being agreed fuelled by lower interest rates compared to the previous year when interest rates had peaked.

The number of sales agreed in 2024 was almost double that of the increase in new listings entering the market and highlights that average 2-year fixed rates now at 5.05% and 5-year options at 4.80% has resulted in more buyers returning to the market as affordability improves.

Higher interest rates, lack of availability and stubborn house prices meant 2023 was a stand off between buyers and sellers with a significant reduction in transactions as opposed to house prices, which was much predicted. Fast forward to the end of 2024 and lower inflation, a couple of cuts to the base rate, reduced interest rates, wage growth, and more choice for buyers has given much better market conditions for people wanting to make a move.

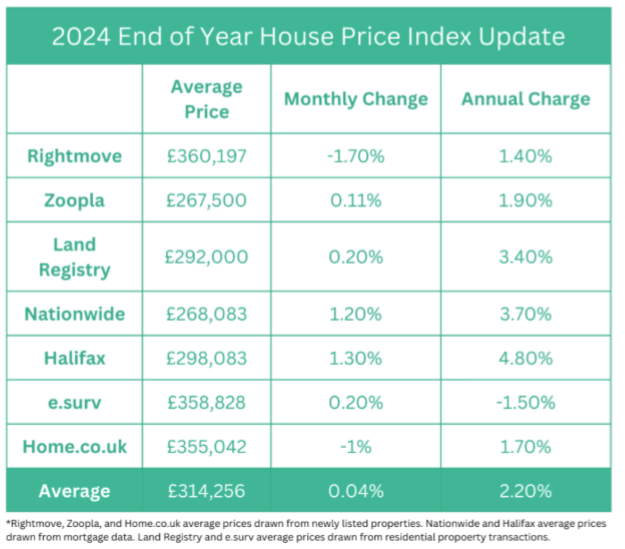

The latest land registry data has the average UK property price at £292,000, which is 3.4% higher than a year ago, and 1.25% above the peak of September 2022 before interest rates started to significantly rise in the aftermath of the infamous Truss/Kwarteng budget.

Property prices dropped by 3.90% in the six months from September 2023 to February 2024 before they started to rise again as the market showed resilience throughout late 2023 and early 2024, before starting a recovery phase as the year went on and interest rates continued to come down steadily.

The number of sales agreed in 2024 was a lot higher than 2023, but this was to be expected following a tough year for the property market and going through the recovery phase.

When comparing the 2024 sales number with the five-year average, they are just shy of being 1% higher and this is a great result and true evidence of just how resilient the property market has been with all the political and economic turmoil that it has faced over the past five years.

However, it has not been all plain sailing as sellers have had to continue to realign their expectations when it comes to asking prices with an almost 30% increase in the number of properties having to reduce their asking price in comparison to the five-year average.

Properties that have had to reduce their asking price behave very differently to those that sell without the need to reduce their asking price. Reduced properties are less likely to sell and if they do end up selling, they will take longer to do so and are more likely to have a sale fall-through, and are also twice as likely to switch estate agents.

This is clearly evidenced in the higher number of properties withdrawing from the market having not sold, more sales falling through, and a higher number of sellers returning to the market as well. Here are some statistics from 2024 that make interesting reading:

41.35% of properties had a price reduction

54.30% of properties ended up selling

23.41% of sales fell through

This data highlights that whilst transaction levels and house prices have risen, sellers must be realistic with their initial asking prices, have exceptional marketing and work with a very reputable agent if they want to end up securing a buyer and seeing it over the finish line to completion in 2025.

In conclusion, 2024 was a fantastic year of recovery for the property market with an increase in listings, sales, mortgage approvals, transactions and house prices helped by lower inflation, cheaper mortgages, wage growth and higher consumer confidence. As you can see above, several of the latest HPI reports indicate a 2.2% average increase in house prices throughout 2024.

There were still some factors in 2024 that could knock confidence such as the election and budget, but recent history has shown us for the most part, the UK property market has been very resilient in reacting to the constant barrage of political and economic changes that has been thrown at it over the past decade. Now we have reviewed the 2024 property market finished up, let's take a look at the early signs of what is perhaps to come in 2025.

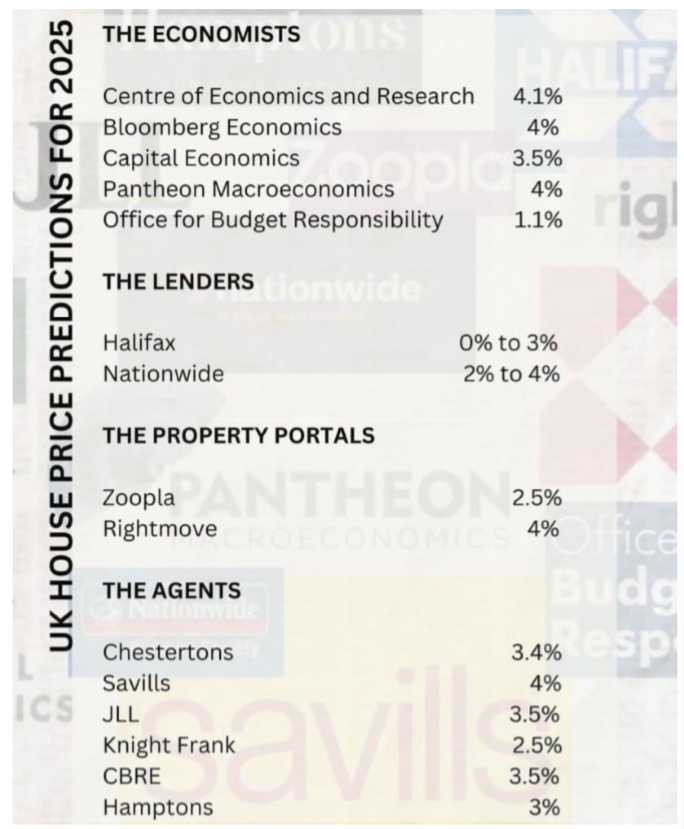

The below image highlights the house price predictions for 2025 from the major players and it makes positive reading for the property market.

The positive end to 2024 sees no clear signs of slowing down as we enter 2025 as proven by these predictions and the positive market activity being reported currently as well. The positive 2025 house price predictions help to underscore the fascinating behaviour of the UK and our obsession with property as the number one investment.

When people hear good news, they don’t just file it away and move on; they act on it. This is exactly what happened with the booming market post Covid with record low interest rates, the stamp duty holiday, and relocations out of urban areas to more rural locations as working from home became more popular. These positive house price predictions, lower interest rates, increased mortgage approvals, and so on creates a feedback loop where the perception of a healthy market fuels even more market activity.

Rightmove reported in their December House Price Index that sales agreed were up 22% and new buyer demand was up by 13%, whilst Zoopla data highlighted that sales agreed were up 23% and buyer demand by 22%. Rightmove also had a record breaking Bouncing Day with 2024 marking their busiest ever for both new property listings and traffic to the site as people prepare for their 2025 moves.

Their data shows a 26% increase in the number of new properties listed for sale compared to the previous record of 2023 and is further evidence of the confidence in the market for people to make a move in the year ahead. Nearly half (46%) of homes coming onto the market were ‘second stepper’, three and four bed properties and this is a great sign of increased activity in a sector of the market that really struggled throughout 2023 with affordability due to higher interest rates.

The other positive sign was 35% of new listings were smaller homes typically bought by first time buyers who are vital for market activity as they were the biggest buyer group in 2024, making up 36% of all purchases according to Zoopla. The supply of new properties hitting the market on Boxing Day was matched with buyer demand as enquiries sent to estate agents about homes for sale was 20% higher than last year and was also the highest number of visits on Boxing Day in history, surpassing the previous record set in 2021 as buyers look to take advantage of the increased choice.

Latest mortgage approval for house purchases in November 2024 was 8.77% above the 12-month average and 32.14% higher than November last year.

This is another sign of future market activity and evidence we are on course for a very strong start to 2025.

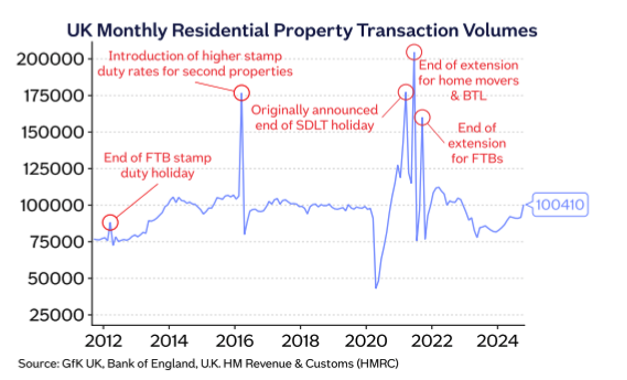

We should not forget though that the stamp duty changes at the end of March could cause some uncertainty and perhaps a quieter Q2 where buyers and sellers try to get a feel for what will happen to the marker going forward with higher stamp duty bills.

As you can see from the above graph, you tend to get a spike in transaction numbers in the lead up to stamp duty changes, followed by a drop off immediately after the changes, and then a return to normal activity, so I don’t think the stamp duty changes are going to impact prices and activity too much.

Yes, there will be a period of transition where those involved in the buying and selling of property figure out what the stamp duty changes mean to them, but remember, without getting all political, these are not stamp duty increases, but reverting back to previous stamp duty brackets prior to Covid that we had been used to. However, I must add that I think the changes to stamp duty for additional purchases and not extending or altering stamp duty for first-time buyers and former owner-occupiers was not the right move to make for the property market. What is probably going to happen is buyers and sellers will just factor in the higher stamp duty bill into their offers in the same way they have done with the reduced purchasing power from higher interest rates over the past couple of years. For example, buyers reducing their budgets or extending their mortgage terms to help them with their house purchase has been on the rise to cope with stretched affordability.

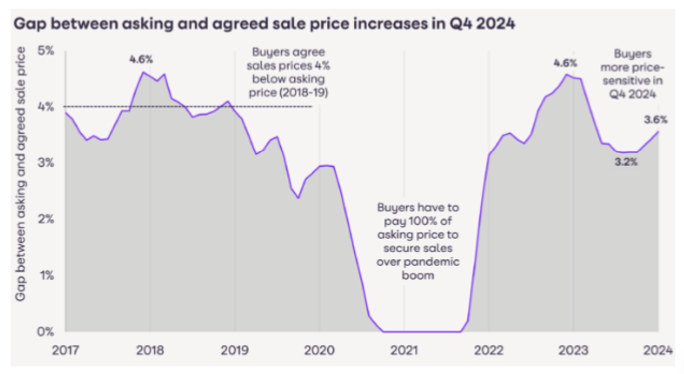

As you can see from the graph below, the gap between asking and agreed sales prices took a hit in 2023 before recovering in 2024 and actually to a smaller gap than was seen in 2018-2019 before the pandemic.

Therefore, it would appear there is still room for the gap to widen a bit to combat higher stamp duty payments and to not impact house price growth or activity levels.

Now, what is my crystal ball telling me for 2025?

All the data I have researched suggests that we should be on course for low unemployment, wage growth, steady inflation, a few cuts to the base rate, a slow and steady drop to interest rates, rents going up, house price growth of 3%, and a 5% increase to 1.15 million transactions in 2025.

This is of course excluding any potential black swan events that could impact the property market, so we will have to wait and see at the start of 2026 how many of these predictions are right.

Thank you for reading my market update for 2024 and predictions for 2025. Please do feel free to get in contact if you have any questions or wish to discuss anything further that you have read.

As always i am happy to provide you a free valuation on your home whether you are selling or not.

Home Buyers:

Houses for sale in Irlam

Homes for sale in Cadishead

Property in Salford

Buy a house in Manchester

First-time homebuyer tips

Affordable homes in Manchester

Property listings in Salford

Housing market trends in Manchester

Best neighbourhood in Salford

Family-friendly homes in Manchester

For Home Sellers:

Sell my house in Irlam

Sell my house in Cadishead

Property agents in Salford

Home valuation in Manchester

Tips for selling your home

Home staging tips

Housing market forecast 2025

Selling your home fast

Negotiation tips for selling homes

Avoiding common home selling mistakes

General Property:

Property investment strategies

Rental properties in Manchester

Property management services

Housing market analysis

Upcoming developments in Salford

Housing market predictions 2025

Property contracts explained

Crowdfunding for property investments

best estate agent in manchester

best estate agent in salford

best estate agent in irlam

best estate agent in cadishead

estate agent in irlam

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link