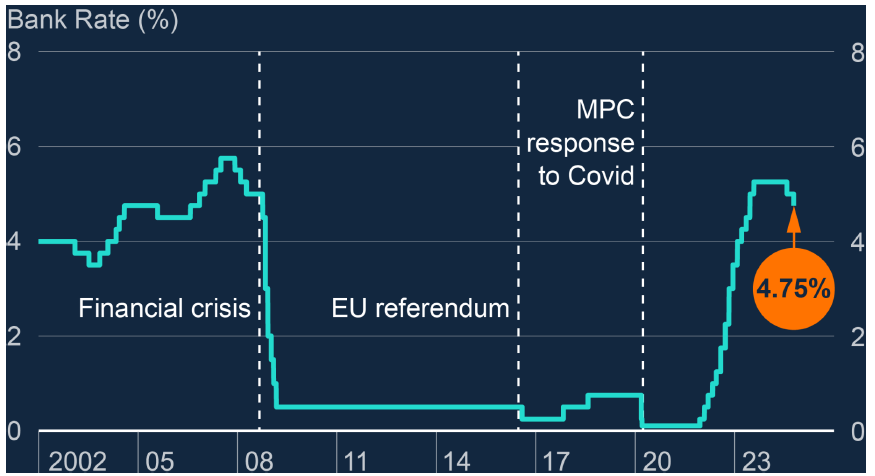

Base rate cut to 4.75%

The Bank of England has today announced the second Base Rate reduction of the year, seeing it drop from 5% to 4.75%.

This outcome was widely expected by the financial markets, but the decision did see all but one of the committee vote to reduce the Base Rate to its lowest level since May 2023. This is an indication of much wider support for this move compared to the 5-4 vote split for the first rate cut back in August.

The last meeting in September also saw the MPC vote overwhelmingly in favour of keeping the Base Rate unchanged at 5% with all but one of the nine-strong committee supporting the decision to pause, so this is perhaps a sign that the majority are in support of a quarterly cutting cycle.

This Base Rate decision comes at the end of a run of important economic and political events following the budget and US election.

This has resulted in a view that the Base Rate will be cut at a more moderate pace than previously expected and has been priced in by lenders.

Therefore we are likely to see average mortgage rates drift up a little in the short term, before starting to fall back again.

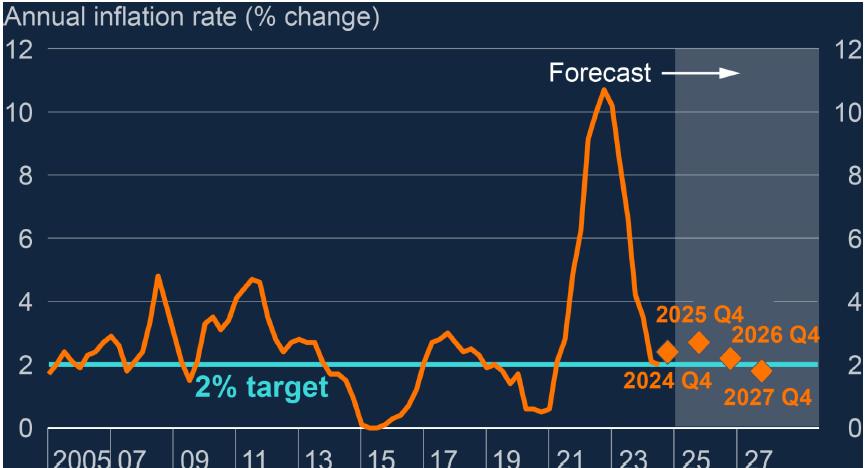

Updated economic projections from the BoE presented in the latest quarterly Monetary Policy Report supported this cautious message. From a current rate of 1.7%, inflation is expected to move back up to 2.5% by the end of the year, and climb further over the course of 2025 before peaking around 2.8% in Q3.

With this in mind, the markets have reduced the probability of a rate cut in December to just 25%, down from 35-40%, with a 0.25% reduction by February almost fully priced in.

What’s happened to mortgage rates recently?

Some lenders have been increasing their rates in recent weeks, whilst others have been reducing them as there has been quite a bit of movement in swap rates, which has meant lenders have needed to reprice their mortgage products back in line with the rest of the mortgage market.

The average rate on 7 November 2024 for a five-year fixed rate mortgage is 4.7%, up from 4.64% the week before.

The average rate for a two-year fixed rate mortgage is 4.95%, up from 4.91% the week before. The lowest available 5-year fixed rate mortgage is 3.84%, and the lowest available two-year fixed rate is 3.96%, both unchanged from last week. Whilst a drop in the base rate won’t significantly impact interest rates immediately as you can see from the figures above, particularly with the reaction to the swap and gilt rates following the budget, it should follow suit of the positive reaction to the 0.25% cut at the start of August and help expedite movement in the market.

The decline in the base rate had already been factored into lower mortgage rates, which have reached a two-year low over the autumn and this has definitely helped bring a return of buyer activity to the market.

Given the outlook for the base rate, there are many predictions that we will see the current average rates of 4-5% remain throughout 2025.

The Office for Budget Responsibility has recently released their economic and fiscal outlook which sets out their central forecast for the next five years, taking into account recent data and government policies.

They reported that average interest rates on the stock of mortgages are expected to rise from around 3.7% in 2024 to a peak of 4.5% in 2027, then remain around that level until the end of the forecast.

The high proportion of fixed-rate mortgages (around 85%) means increases in Bank Rate feed through slowly to the stock of mortgages.

Bank of England analysis shows around two-thirds of fixed-rate mortgages have been repriced since the start of this hiking cycle, and UK Finance analysis shows that around 1.8 million will end next year.

What could lie ahead for interest rates?

Goldman Sachs recently predicted that the base rate could fall to 2.75% by next November, although it is more ambitious than other previous predictions with the International Monetary Fund suggesting back in May that the base rate could drop to 3.5% by the end of 2025 and Capital Economics reported back in July that they expect the base rate to hit 3% by the end of next year.

Below are the latest forecasts from Savills for what they believe is in store for interest rates, the property market and economy over the next five years.

As you can see from the above forecast, Savills are predicting a gradual improvement in conditions and this stability should see more people enter the market as they feel comfortable in their moving decision.

The bounceback in activity for new listings, sales agreed, and house price growth in 2024 is evidence that interest rates averaging 4-5% can 100% support the market and if conditions improve further slowly but surely, the market will react positively to this despite continuous political and economic uncertainty.

Therefore, we should expect a continued but steady upward trajectory for transaction levels and house prices.

Reaction to the budget

On 30th October the nation saw the much anticipated first budget from a Labour government since 2010.

The property market reacted with an initial slight panic to immediate changes on Stamp Duty for purchasing additional homes which saw it increase from 3% to 5% as of 31st October. According to Nationwide and based on data for the year to June 2024, this change would affect approx 20% of transactions.

There were also no mentions of any extensions or changes to existing stamp duty thresholds for those buying the only residential property they own or if they are buying their first home. Therefore, as of 1st April 2025, paying stamp duty for those who have owned a home before and are buying their only residential property will go from paying nothing up to £250,000 to starting paying 2% from £125,001 to £250,000.

For first-time buyers the amount in which they are not liable for stamp duty will reduce from £425,000 to £300,000 and 5% on the portion from £300,001 to £500,000, down from £525,001 to £625,000. If the price is above £500,000, a first-time buyer will not be able to claim any relief.

Consequently, this could arguably dampen demand in the market causing transaction levels to drop and house prices to decrease, but is that going to be the case…..

What has actually happened in the week following the budget?

Below I will breakdown activity levels in the week following the budget compared to the week prior to it:

1. New listings are down 2.73%

2. Sales agreed are down 0.80%

3. Asking price on sales agreed up 0.3%

4. Price reductions are up 19.64%

5. Fall-throughs increased by 0.16%

6. Sellers re-entering the market increased by 77.34%

As you can see from the figures above, there has not been a massive difference in activity levels for new listings, sales agreed, asking prices or sales falling through in the week following the budget compared to the week prior to the event. Therefore, it appears those thinking of moving in the near future have not been put off as a result of the budget. The fact that a lot of sellers have adjusted their asking prices and a huge increase in sellers entering the market again is a clear vote from sellers as to their view on the market going forward.

What’s next?

The uncertainty of the budget is behind us, a cut to the base rate has happened and we have stamp duty reverting back to where it was in 2022 at the start of April.

Therefore, we expect to see an increase in transaction levels between now and the end of March as buyers aim to take advantage of the current stamp duty thresholds before the end of March deadline.

Anyone considering taking advantage of the current situation should act sooner rather than later as it is currently taking an average of 213 days from listing a property to completing a transaction according to Rightmove. Many people can be put off listing their home in the winter months now that the days are

shorter, but with the right pricing and marketing strategy in place, there is 100% pent up demand out there that sellers can tap into and help get moved ahead of schedule.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link