The 2024 Autumn Budget

Today was the first of many, which saw the first budget from a new government in fourteen and a half years, the first budget from the country’s first female Chancellor, Rachel Reeves, and the first from Labour since March 2010.

Ongoing cost of living pressures and described by Labour as one in which difficult decisions would be made on tax, spending, and benefits meant the lead up to this budget has had a lot of coverage in recent weeks. With the clocks going back, the days getting shorter, and temperatures dropping, the country was bracing themselves for a bleak and dark reaction to the budget. So what were the main talking points for the UK property market following this hotly anticipated first Labour budget in fourteen and a half years? There is so much that could be discussed, but below are five points I am going to discuss that I believe could have an imminent impact on the property market.

1. Stamp Duty Land Tax increases

2. Capital gains tax on property paused

3. VAT added to private schools

4. Inheritance Tax paused

5. Mortgage Approvals

Stamp Duty surcharge and Capital Gains Tax for second homeowners.

The stamp duty surcharge on purchasing additional homes will now increase from 2% to 5% as of 31st October.

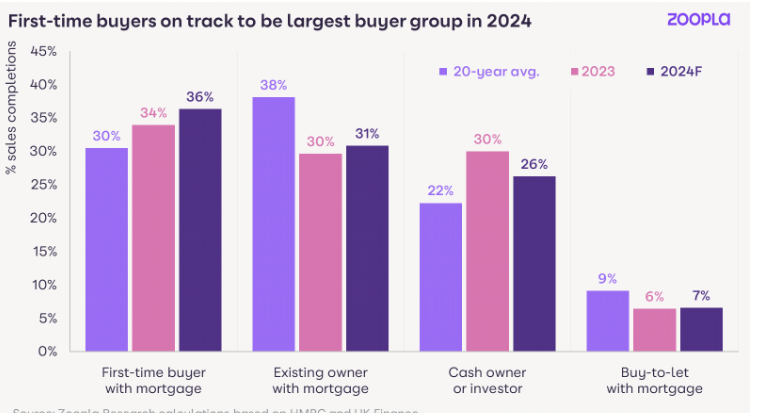

We have already seen a reduction in the number of buy-to-let investors in the market compared to the twenty-year average due to rising interest rates, taxes, and legislation as you will see from the below chart from Zoopla.

This further increase in tax will no doubt deter some investors from purchasing properties to rent out.

Capital gains tax on residential property remains at 18% and 24% and would suggest we are more likely to see investors exiting the market than entering it as there will be no increased tax from selling their additional properties as opposed to the increased tax if they were to purchase an additional property.

Data from Rightmove in September found a record number of former rental properties listed for sale, with almost 1 in 5 (18%) having previously been rented out.

Despite this trend of landlords deciding to sell up, the average number of rental homes being put on the market for sale over the past five years has been 14%, so it does not appear to be a mass exodus.

Zoopla have also reported that 40% of formerly rented properties that are for sale end up being rented out again. This will be due to a considerable amount of properties ending up not selling and some of these properties being sold to another landlord who then rents the property back out. It does appear landlords have been taking early action to sell off properties due to rising costs, legislation, and perhaps the realisation that once they knew Labour would come into power that the writing was on the wall for them. Therefore, whilst we still might see an increase in the number of landlords exiting the market, it does appear that the majority of landlords had already made their decision in advance of the budget happening.

In conclusion, this will mean a continued lack of properties available to rent as the landlord market shrinks and thus will push rents up even further as demand continues to outstretch supply.

Stamp Duty Land Tax

There were no mentions of any extensions or changes to existing stamp duty thresholds for those buying the only residential property they own or if you are buying your first home.

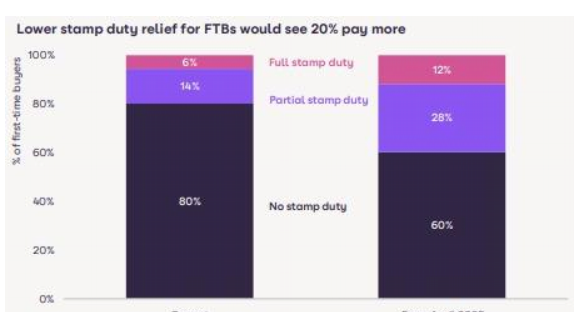

Therefore, as of 1st April 2025, paying stamp duty for those who have owned a home before and are buying their only residential property will go from paying nothing up to £250,000 to starting paying 2% from £125,001 to £250,000. For first-time buyers the amount in which they are not liable for stamp duty will reduce from £425,000 to £300,000 and 5% on the portion from £300,001 to £500,000, down from £525,001 to £625,000. If the price is above £500,000, a first-time buyer will not be able to claim any relief.

As you will see from the below chart, according to Zoopla, there will be a 20% increase in the number of first time buyers who will be liable to pay stamp duty as of 1st April 2025

Interestingly, the latest data from Rightmove is suggesting it is taking an average of 152 days to go from SSTC to completion, so for anyone purchasing a new home and wanting to take advantage of the current stamp duty relief before it expires, they must take action now to avoid paying extra tax on their purchase

VAT added to private school fees

The standard 20% VAT rate will be added to private school fees from 1st January 2025. Any fees paid from 29th July 2024 relating to the term starting in January 2025 and onwards will be subject to VAT. There are approx 2,500 private schools in the UK, educating about 7% of all pupils and it is estimated that private school attendance could fall by between 3% and 7%. Families who send their children to private schools will now face a significant rise in their costs at a time when budgets are already under pressure.

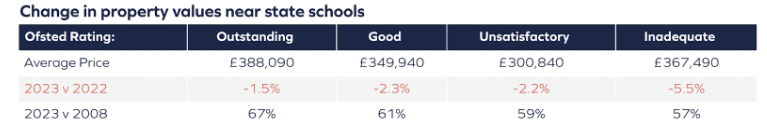

While some will be able to adjust, others will likely move their children into state education. As a consequence, demand for homes near top-tier state schools will likely rise.

As you will see from the above chart, property values near state schools with outstanding Ofsted ratings have unsurprisingly had the highest price growth in recent times and this might rise further with more buyers potentially searching for homes in areas that have outstanding schools with the upcoming addition of VAT to private school fees.

Inheritance Tax

The chancellor has extended the inheritance tax threshold freeze for another two years, until 2030.

The tax-free amounts remain £325,000 or £500,000 for residences left to direct descendants, and £1,000,000 for married couples combining their allowances.

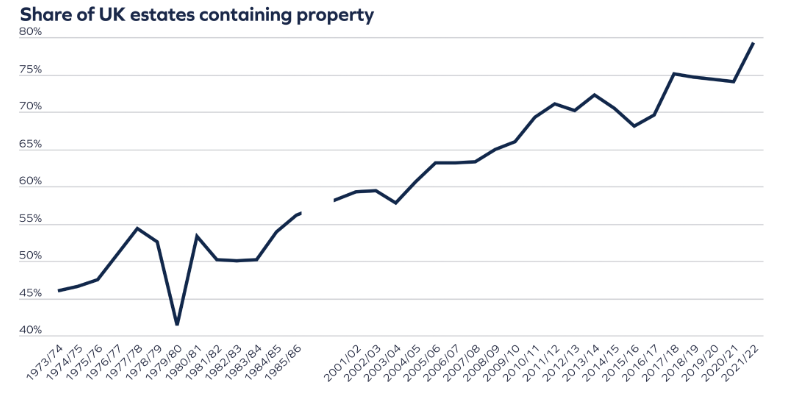

The latest figures from HMRC show that a record 79.2% of UK inheritances in the 2021-2022 tax year contained a home, equating to 175,000 of the 221,000 estates containing assets, with only 13% paying inheritance tax.

People passing away today are more likely to own their home than ever before and this has meant the share of estates containing residential property being passed on has risen steadily over the years.

Inheriting a property has been the path for many into homeownership and the freeze today will be welcome news to those who will be potentially inheriting a property in the next few years.

Conclusion

Whilst I do not have a crystal ball to predict how the property market is going to react to the budget, I have analysed the number of mortgage approvals seen over the two months prior and after the last ten budgets since March 2020 to see how the prospect of of an impending budget impacts buyer activity across the market.

On average, the number of buyers entering the market has increased 10.6% following a major budget.

However, when taking the unusual events of both the pandemic boom market and the Truss mini budget out of the equation, the figures show the average boost to mortgage approval levels following a budget sits at 2.9%.

Interestingly, following the catastrophic Truss/Kwarteng budget of September 2022 that saw interest rates sky rocket to a 15-year high and mortgage approvals fall by 22.1%, there was a 19.6% rise in mortgage approvals after the following budget of March 2023 and on average, mortgage approvals have increased by 12.6% after the last three budgets.

In conclusion, just like with elections, the impact of a budget will cause some political and economic uncertainty, which the property market does not react too kindly to prior to the event.

However, the latest data shows us that market activity and prices more often than not, move in a positive direction following an election or major budget, and the summer election is evidence of that with a strong Q3 performance for the number of new listings entering the market and sales being agreed. The latest Rightmove HPI reported strong levels of activity in the typically busy autumn season, and lots more people looking to get on with home moves than they saw in the more

muted market of 2023.

According to Rightmove, the number of sales agreed is currently up 29% compared to the same time last year, while the number of people sending enquiries to estate agents about homes for sale is up 17%.

On top of that, buyers will also find more choice of homes, with the number of homes for sale up 12%. While there’s lots of activity in the housing market, they did see lower-than-average growth in house prices this month (+0.3%), compared to the seasonal average of 1.3%. This shows that the market is still price sensitive, and sellers coming to market need to set a realistic asking price to find a buyer. There is also further evidence of positivity in the market with the level of mortgage approvals in September hitting 65,600, which is the highest level seen since August 2022, just before the Truss-Kwarteng budget.

Not only this, but mortgage approvals have gone up four months in a row now and were 51.5% higher than September 2023. Therefore, it would appear that the prospect of a new government and a budget as I mentioned earlier, which Labour described as one in which difficult decisions would be made

on tax, spending, and benefits has not slowed the market down. We have had so many massive political and economic events over the past decade that could have easily caused the property market to derail, but the market has remained very resilient and we do appear to have now got to a point where the public are saying if they want to move and they can, now is the time to do it. It will be very interesting to see how the market reacts in the final two months of the year

following the budget, but there is certainly a renewed optimism amongst homemovers regarding a potential move as interest rates have continued to steadily come down over the past year and there is a lot more choice of property available to buy than there has been in recent years.

We are never far away from another event or headline that could impact the property market, so all eyes will be on the next MPC meeting on 7th November to see if there will be a further drop to the base rate and perhaps an early Christmas present for homemovers.

For those looking at placing their property on the market and securing a buyer before 2024 is out, they might want to take action sooner rather than later. According to Rightmove it is currently taking 61 days to find a buyer and this would mean listing their home at the start of November to have a sold sign outside before we enter 2025.

- #AutumnBudget2024

- #PropertyMarket

- #ManchesterEstateAgent

- #SalfordProperty

- #UKHousing

- #StampDuty2024

- #FirstTimeBuyers

- #InvestInProperty

- Autumn Budget 2024

- UK property market

- Salford Manchester estate agent

- 2024 housing market predictions

- Property investment UK 2024

- Stamp duty changes 2024

- Real estate trends Manchester

- Salford housing market insights

- Estate agent insights UK budget

- Manchester property budget impact

- Affordable housing 2024 UK

- Buy-to-let changes 2024

- First-time buyers Salford

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link