What could a general election mean for the UK property market?

What a 24 hours it has been for the UK property market!

Inflation hit a three-year low of 2.3%, the annual price change for a property in the UK was up 0.7%, a cut on the base rate was on the cards for June, and there was a renewed positivity in the air.

However, this positivity turned to uncertainty when Rishi Sunak called a snap election for 4thJuly. The impending general election adds another layer of complexity to an already complex property market.

Political campaigns and elections historically create uncertainty and this influences market sentiment and investor confidence. Because of this, I’m going to be looking back at what previous elections have meant for the UK property market, what we can expect to happen in the lead up to the July election and

the months ahead. A general election can have a significant impact on the property market, influenced by the policies of the competing parties, the stability of the political climate, and the general economic outlook.

Here are some key ways in which a general election might impact the UK property market:

1. Market Uncertainty:

Pre-Election Period: Leading up to an election, uncertainty often increases as buyers and sellers adopt a ‘wait-and-see’ approach. This can lead to a slowdown in

property transactions and price fluctuations.

Post-Election Period: Once the results are in, the market often responds to the perceived stability or instability of the new government. A clear majority may boost

confidence, whereas a hung parliament might prolong uncertainty.

2. Policy Announcements:

Housing Policies: Parties often campaign on housing policies, such as changes in property taxes, stamp duty reforms, affordable housing initiatives, and rental market regulations. These policies can directly impact buyer behaviour, property prices, and rental yields. Taxation and Spending: Broader fiscal policies, including income tax, corporation tax, and government spending on infrastructure, can influence economic growth and consumer confidence, thereby impacting the property market.

3. Economic Outlook:

Confidence and Investment: Elections that result in a government perceived as business-friendly can boost investor confidence, leading to increased investment in

the property market. Conversely, policies seen as detrimental to economic growth can dampen investment.

Interest Rates: The economic policies of the new government can affect interest rate expectations. Higher rates can increase mortgage costs, potentially cooling the property market, while lower rates might stimulate it.

4. Regulatory Changes:

Planning and Development: Changes in planning laws and regulations can affect the supply of new housing. A government that eases planning restrictions might

encourage development, increasing supply, and potentially stabilising prices.

Rental Market: Regulations affecting landlords and tenants, such as rent controls or changes in tenancy laws can impact the rental market, influencing investment

decisions and rental prices.

5. Regional Variations:

Policy Impact By Region: Different regions may be affected differently depending on the specific policies proposed. For instance, policies aimed at boosting the

Northern Powerhouse might lead to increased property investment in the North of England compared to other areas.

Overall, while the immediate impact of a general election on the UK property market can be marked by uncertainty, the long-term effects are largely determined by the new government’s policies and their execution. Investors, buyers, and sellers closely watch election outcomes to gauge the potential direction of the market.

Not so long ago, the uncertainty created by general elections would cause many households to put on hold a decision to move.

However, have the past decade’s political ups and downs, including Brexit and the pandemic, made people slightly more comfortable with uncertainty?

The number of properties for sale, new listings entering the market, and sales agreed are all up in the first four months of 2024 compared to 2023 and the six-year average.

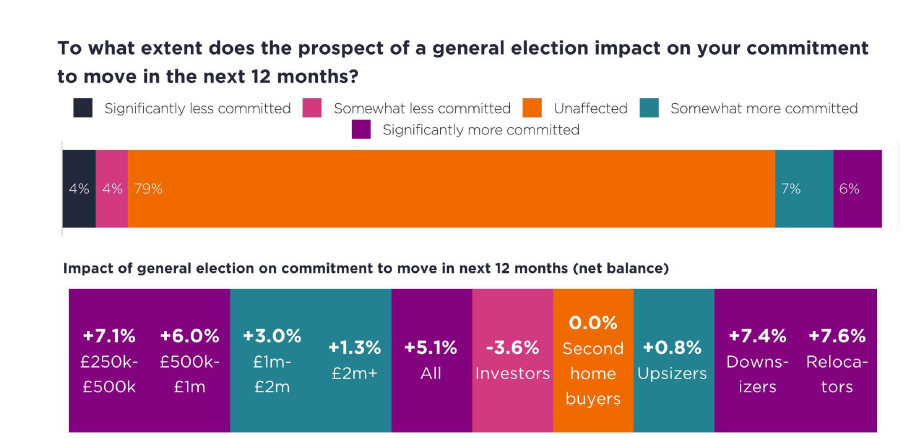

A survey conducted by Savills in April highlighted that 79% of respondents moving plans in the next 12 months were unaffected by the prospect of a general election, with 13% more committed, and only 8% less committed. With the above data, the answer appears to be a resounding yes and that people have

changed from a wait and see approach to a just get on with it approach. Over the past decade, major political or economic events have had less impact on prices

and transactions than has been the pattern in the past.

The main reason why the general election has not impacted the commitment of those looking to move over the next 12 months is the stance of the two main parties.

Whilst at present, the odds may suggest a new Prime Minister at 10 Downing Street, thecurrent leaders of the two main parties are not a million miles apart with both pitching strongly for the centre ground, and this limits the likelihood of radical change. For a general election to have a major impact on the property market the outcome would need to raise the possibility of material change in the macroeconomic backdrop, direct housing or property taxation. Often that isn’t the case.

Any change of government is more likely to be felt at the upper end of the market, where there could be a threat of more taxation and where discretionary moves tend to be confidence-driven.

A Labour victory appears the most likely outcome and while it has ruled out introducing rent controls or wealth tax, other measures could dampen demand in prime property markets.

These proposals include overhauling the non-dom tax regime, increasing the 2% stamp duty surcharge for overseas buyers, adding VAT to school fees, and changing inheritance tax rules.

Sound economics is likely to be a central theme of both parties’ general election manifestos. If the election is fought on the centre ground and mortgage rates begin to fall, this should mean an increase in the number of transactions.

On the assumption that there are no further significant shocks to the economy, the gradual decline in mortgage rates should encourage more households to plan a move, kickstarting the beginning of a recovery. Wage growth and a price correction in real, if not absolute terms should ease affordability pressures for those upsizing, but higher rates than we have become accustomed to in recent times, plus the possibility of political uncertainty will constrict transaction numbers and

reduce the chance of a significant rebound.

What do previous elections tell us about what to expect?

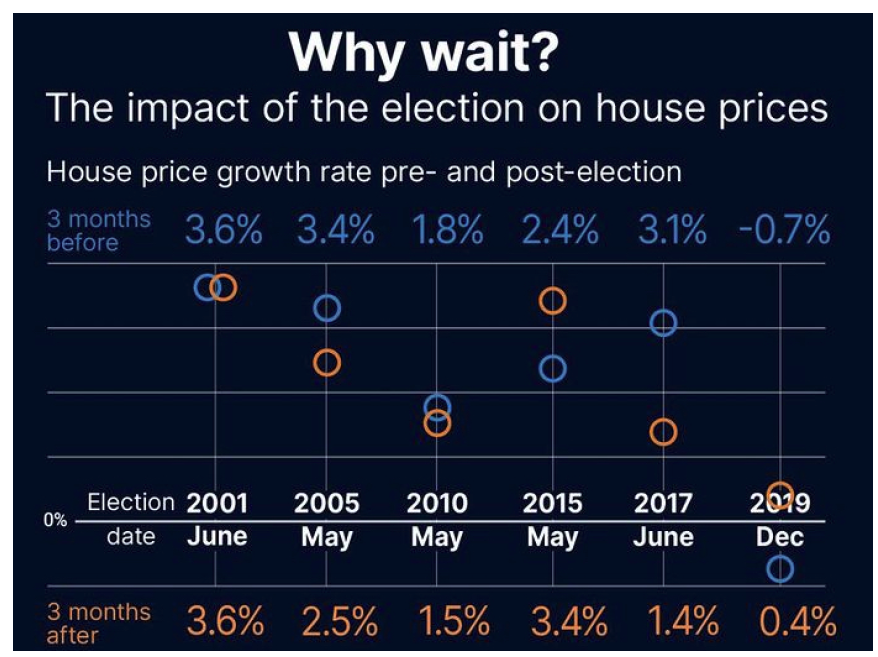

There has been research conducted by Dataloft which looked at price changes before and after the general elections since May 1997.

In the three months before the December 2019 election, it found that prices increased across the UK by 4.2%. Three months after the election, the price increase was just 0.7%. Prices rose by almost the same percentage prior to Tony Blair’s win in 1997 as it did with the victory of Boris Johnson in 2019.

Only in 2005, 2010, and 2017 elections did the price growth exceed the preceding period. In the other four elections, prices continued to grow in the three months post-election, but at a lower rate.

Pre-election uncertainty has a short-term impact, according to the research, with the number of sales in the months before voting day reducing. This pattern holds true for six out of the last seven elections. Once the result of the election is known, the increased certainty normally means momentum picks up again.

Market insights from Hamptons has also uncovered that the belief that a change of government creates uncertainty is actually rather different from reality.

Their findings show that governments time the calling of general elections very carefully, targeting the period when the economy and the housing market are strengthening.

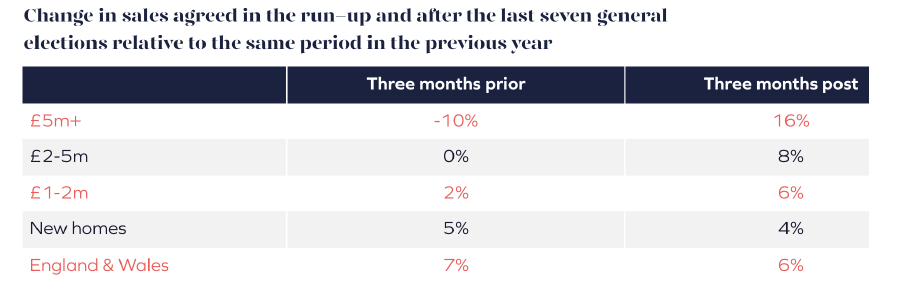

It is no coincidence that the election was called on the day that inflation hit its lowest point for three years, house prices were up annually, and this follows the news from earlier this month that the economy grew by 0.6% between January and March, the fastest rate for two years. Hamptons highlighted the sale numbers with their analysis of the past seven general elections showing a 2% increase in the number of homes that changed hands in England

and Wales in an election year, compared to the previous 12 months. They also identified a 7% increase in the number of sales agreed in the three months prior to

an election and a 6% rise in the three months post election. The argument again here is that this predominantly reflects a strengthening of the economy

and underlines that for the mainstream markets, a general election is not a major consideration, thus the outcome does not have a material impact on the decision to buy or sell.

A small group of buyers will continue tol play the waiting game as they do with any perceived political or economic uncertainty, but they will be heavily outnumbered by those already entering the market following the strengthening economic outlook. Although general elections do have an effect on the property market, the impact is more complex than it might appear. Elections can cause short-term fluctuations, but the long-term dynamics of supply and demand remain the primary drivers in the property sector.

As buyers and sellers prepare to make their next moves, understanding the historical election trends can be advantageous for those aiming to capitalise on market momentum. Understanding the intricacies of how general elections can influence the property market is crucial for making informed decisions. Whether you’re looking to buy, sell, or invest, staying ahead of the market trends can give you a significant advantage.

If you have any questions or need personalised advice, don’t hesitate to get in touch with us. Please contact us today to discuss your property needs and explore the best opportunities available.

Thank you for reading.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link