Cadishead 2025 Property Market Update

Cadishead Property Market Update: 2025 Year in Review

As 2025 draws to a close, Cadishead's property market tells a story of normalisation, pricing strength and renewed market health. This compact community in Salford, Greater Manchester, positioned along the Manchester Ship Canal with excellent connectivity to Manchester city centre, Trafford and Warrington, has navigated another year of transformation. From family orientated streets where semi detached and detached homes dominate the housing stock, through to newer developments and the evolving character of this established commuter location, Cadishead has demonstrated resilience and genuine value appreciation throughout the year.

A Market Finding Healthy Balance

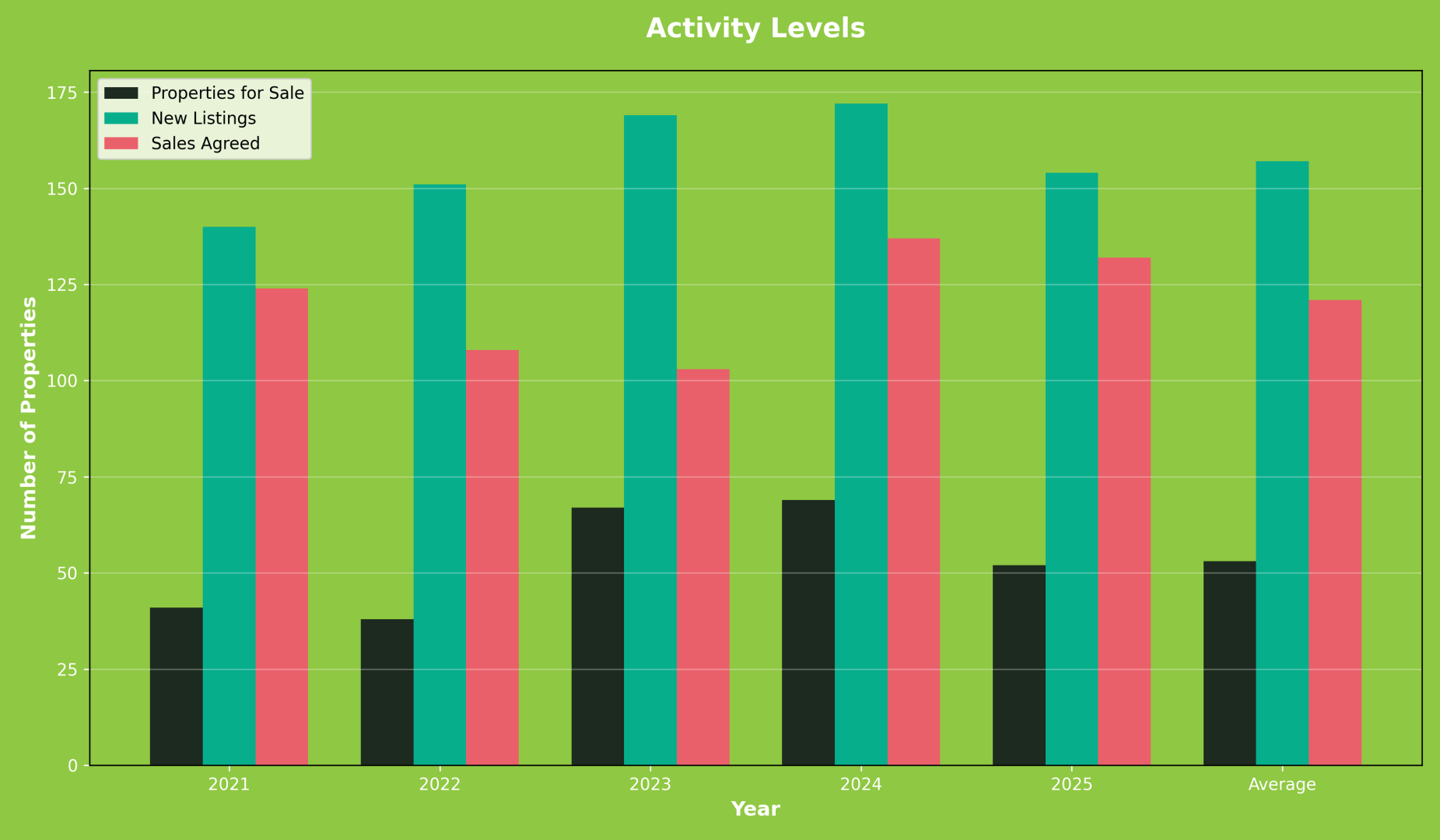

The defining characteristic of Cadishead's property market throughout 2025 has been normalisation following the turbulence of previous years. Properties for sale declined significantly by 24.6% year on year to reach 52 homes, sitting essentially at the five year average of 53. This represents a substantial correction from the elevated levels of 2023 and 2024 when 67 and 69 properties respectively competed for buyer attention. The market has shed excess inventory, returning to more sustainable levels that create neither the scarcity that fuels irrational pricing nor the oversupply that depresses values.

This normalisation touches the entire market dynamic. In established streets like Roseway Avenue, where detached homes command premium valuations with recent sales reaching £345,000 to £395,000, sellers have discovered that quality properties at realistic prices continue moving efficiently. In more affordable areas where semi detached and terraced homes predominate, typically priced from £190,000 to £280,000 based on recent transactions in streets like Allenby Road and Buckingham Road, appropriate pricing generates consistent interest from first time buyers and families seeking accessible entry to homeownership.

The housing stock composition, predominantly semi detached and detached properties offering gardens and parking that families value, has proven advantageous as buyer priorities have evolved. In an era where many sought space following pandemic experiences and where Greater Manchester's growth continues attracting families seeking affordability within commuting distance of employment centres, Cadishead's traditional housing stock meets genuine needs.

New listings throughout 2025 reached 154 properties, down 10.5% on 2024 and running marginally below the five year average of 157. This reduction reflects the market's adjustment to more sustainable activity levels following the elevated supply of recent years. Sellers contemplating moves have proven more selective about timing and pricing, recognising that success requires realistic valuations and quality presentation rather than simply testing the market with ambitious asking prices.

Buyer Activity and Transaction Strength

The sales agreed figures for 2025 deliver encouraging news about market functionality. At 132 transactions, completions declined marginally by 3.6% compared to 2024's 137, yet this figure runs 9% above the five year average of 121. More significantly, this represents substantial recovery from 2023's challenging 103 sales when economic uncertainty and elevated interest rates created buyer hesitancy across the market. The trajectory clearly points upward, demonstrating that Cadishead continues attracting committed purchasers willing to transact when properties offer appropriate value.

This transaction activity spans multiple buyer segments. First time buyers, particularly those working in Manchester city centre where average property prices approach £241,000 yet seeking more affordable entry points with better space provision, have discovered Cadishead's compelling proposition. Properties in the £190,000 to £250,000 range deliver family sized accommodation with gardens and parking at price points accessible to couples and young families building deposits and securing mortgages on modest to middle incomes.

The commuter appeal remains fundamental to understanding buyer interest. Cadishead's positioning within Greater Manchester, with Manchester city centre accessible via the M60 and A57, provides connectivity that families and professionals value. The broader Salford regeneration story, particularly developments at MediaCity and the ongoing transformation of Salford Quays where creative and media industries cluster, creates employment opportunities within reasonable commuting distance. Greater Manchester's economy, forecast to grow at 2.1% annually through 2028 according to recent predictions, substantially outpacing the national 1.6% rate, generates employment and population growth that supports property demand.

Family buyers seeking value have driven considerable activity. In an era where Manchester proper sees average prices around £241,000 and premium areas command significantly more, Cadishead's pricing at £238,326 average for sales agreed delivers Manchester accessibility without Manchester pricing. Three and four bedroom semi detached and detached homes with gardens, driveways and established community atmosphere appeal to families either trading up from smaller properties or relocating from more expensive areas seeking better value and more space.

The buy to let market, while more constrained following recent regulatory changes and mortgage cost increases, continues providing investor activity. With Manchester rental market strength demonstrated by average rents exceeding £1,300 monthly following 10.2% annual increases according to broader market data, investors recognise opportunities. Properties suitable for professional tenants commuting to Manchester or families requiring longer term rental accommodation maintain appeal, particularly when purchase prices remain accessible and rental demand proves consistent.

Pricing Dynamics and Value Appreciation

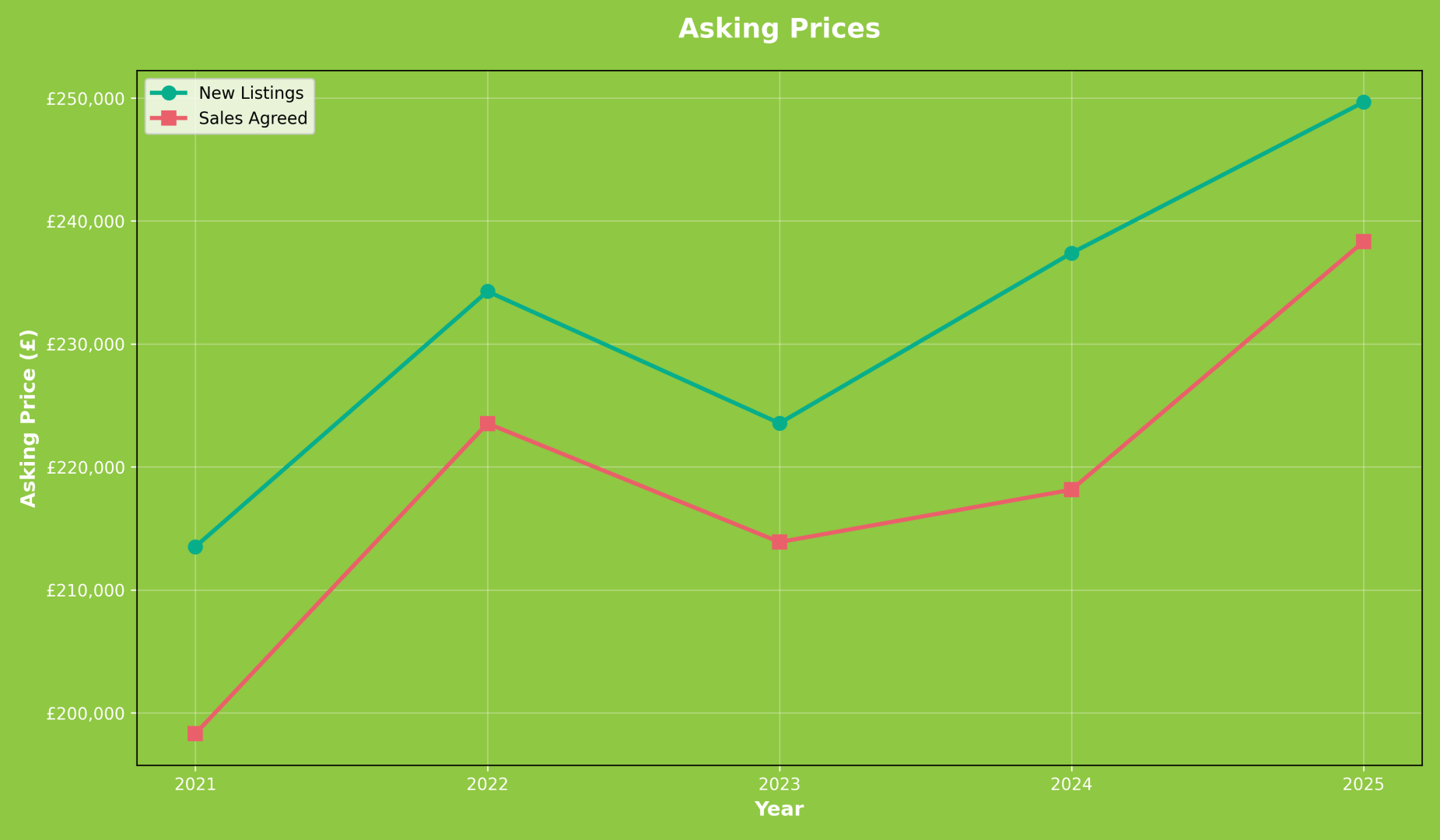

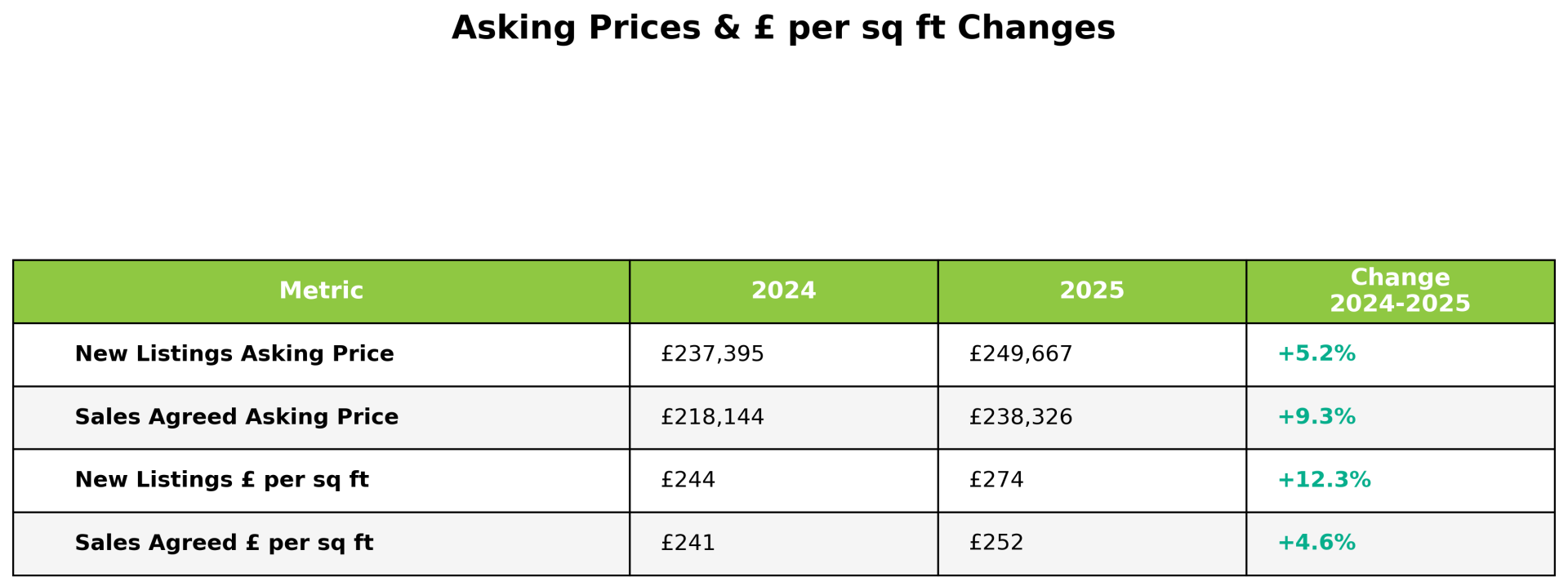

The pricing story across Cadishead's property market in 2025 reveals impressive growth and genuine value appreciation. New listings came to market with an average asking price of £249,667, representing a 5.2% increase from 2024's £237,395. This upward movement reflects growing seller confidence and recognition that Cadishead's market fundamentals support consistent appreciation. From detached homes in premium streets commanding £300,000 to £400,000 plus, through to typical semi detached family homes achieving £220,000 to £280,000, sellers have demonstrated appropriate ambition grounded in market evidence.

More encouragingly, the properties that actually secured buyers achieved an average of £238,326, up an impressive 9.3% from the previous year. This acceleration in achieved prices, growing substantially faster than asking prices, creates a compelling narrative. It demonstrates genuine demand meeting appropriate supply at price points that buyers recognise as fair value. The gap between asking and achieved prices, at around £11,341, reflects normal negotiation rather than dramatic disconnection between expectations and reality.

The price per square foot metrics reveal even more impressive dynamics. New listings averaged £274 per square foot, up 12.3% from 2024's £244, the strongest growth metric across the entire dataset. Sales agreed achieved £252 per square foot, up 4.6% year on year. This substantial growth in per square foot pricing demonstrates that Cadishead properties are genuinely appreciating in value on a per unit area basis, reflecting the area's growing appeal and the quality of stock available.

Understanding these pricing dynamics requires recognizing Cadishead's position within Greater Manchester's broader property landscape. While Manchester city centre apartments might achieve £350 to £400 per square foot and premium suburbs command similar or higher rates, Cadishead's £252 per square foot for sales agreed reflects its positioning as an affordable family orientated commuter location. Yet the 24% growth in new listings per square foot pricing since 2021, from £221 to £274, demonstrates rapid value appreciation as buyers increasingly recognize the area's advantages.

The 17% growth in new listings asking prices since 2021, from £213,512 to £249,667, alongside 20% growth in sales agreed pricing from £198,306 to £238,326, positions Cadishead among Greater Manchester's stronger performing markets. This appreciation reflects multiple factors: Greater Manchester's economic growth and population expansion creating housing demand; Salford's ongoing regeneration and profile enhancement; broader recognition of commuter locations offering better value than city centre equivalents; and the evolving preferences toward family homes with gardens and space.

Market Friction and Health Indicators

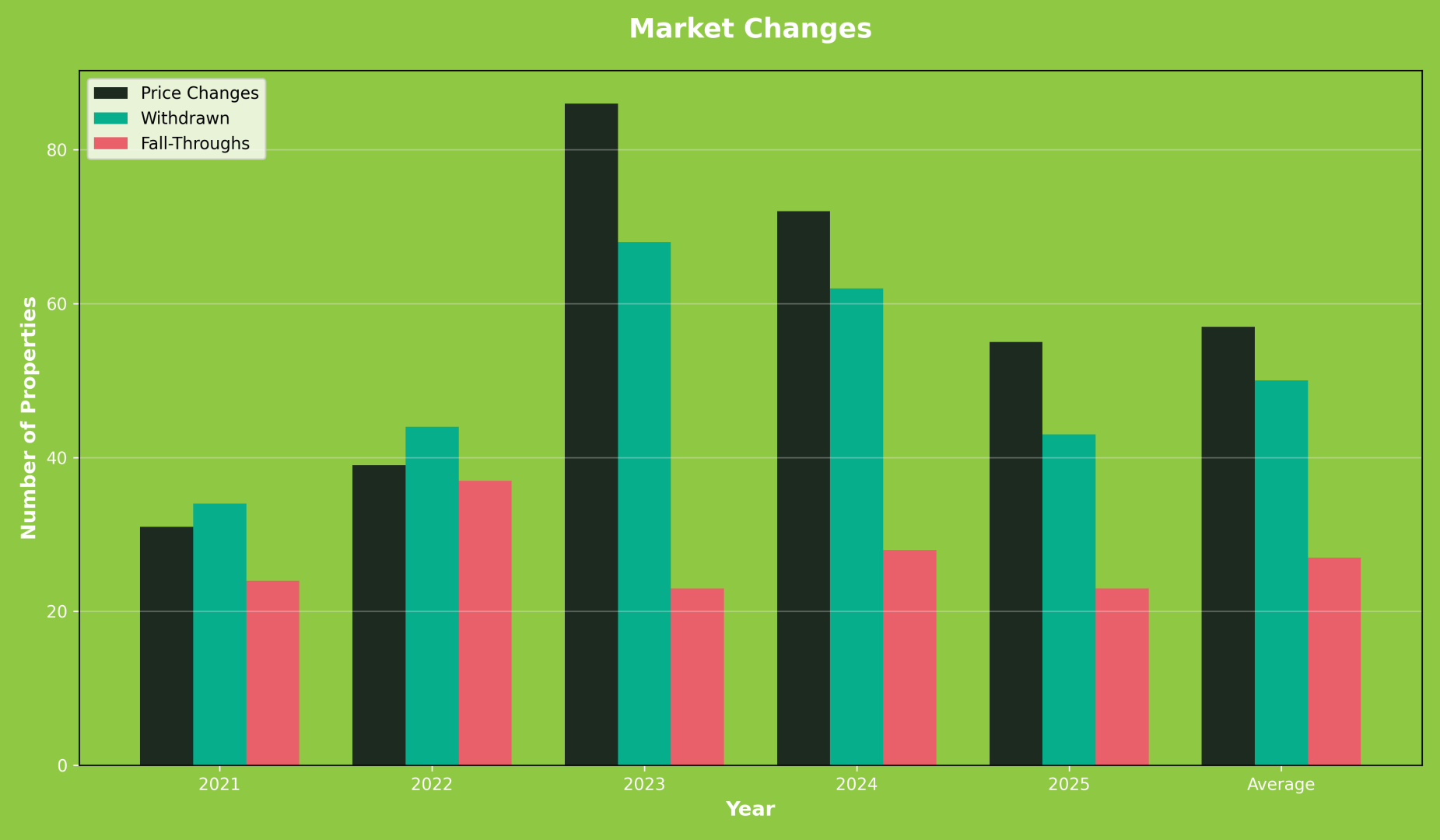

The friction indicators for 2025 reveal a market achieving substantially improved health following the challenges of previous years. Price changes declined dramatically by 23.6% to reach 55 instances, sitting marginally below the five year average of 57. This represents enormous improvement from 2023's peak of 86 price changes when the market struggled with appropriate valuation and buyer expectations. Sellers and agents have clearly recalibrated, launching properties at realistic valuations that generate interest without requiring dramatic reductions.

The price change pattern reflects lessons learned. Properties launching at ambitious valuations based on outdated comparables or unrealistic expectations about what the market will bear now adjust more modestly or, better yet, price appropriately from launch. The dramatic reduction in required price changes demonstrates improved market functioning, with sellers and agents better understanding genuine market value and positioning properties accordingly.

Withdrawn properties declined even more dramatically by 30.6% to reach 43, running 14% below the five year average. This substantial improvement from 2023's peak of 68 and 2024's 62 demonstrates that properties reaching the market are more likely to remain actively marketed until securing buyers. Sellers contemplating withdrawals, perhaps disappointed by initial interest levels or offers received, are instead choosing to persist with realistic pricing adjustments rather than simply removing properties from market.

The withdrawal pattern improvement signals enhanced seller commitment and realistic expectations. Sellers entering the market now possess better understanding of likely timeframes and pricing realities, reducing the frustration driven withdrawals that plagued earlier years. Those who do withdraw typically face genuine changed circumstances rather than simple disappointment with market conditions.

Fall throughs declined by 17.9% to reach 23 collapsed transactions, running 15% below the five year average. This improvement, while more modest than the changes and withdrawals declines, demonstrates that transactions reaching agreement stage increasingly proceed to completion. Survey findings, mortgage valuations and chain complications still cause some collapses, yet the 23 fall throughs against 132 sales agreed represents a collapse rate around 17%, substantially better than the elevated levels of previous years.

The combined friction indicators paint a picture of market health substantially improved from the 2023 peak when 86 price changes, 68 withdrawals and 23 fall throughs suggested a market struggling with appropriate pricing and buyer engagement. The 2025 figures of 55 price changes, 43 withdrawals and 23 fall throughs demonstrate a market operating far more efficiently, with properties generally priced appropriately, sellers committed to seeing transactions through, and completions proceeding more smoothly.

Understanding Cadishead's Property Market Appeal

Throughout these various market dynamics runs a compelling truth: Cadishead continues offering exceptional value within Greater Manchester's property landscape. The combination of affordability, with average sales agreed at £238,326 compared to Manchester's £241,000 yet delivering substantially more space and gardens, positioning within Greater Manchester providing Manchester connectivity without Manchester costs, and housing stock composition favouring families seeking gardens and parking creates enduring appeal.

The area's character as an established residential community provides advantages that newer developments cannot replicate. Mature street scenes, established community networks, local schools and amenities, and that sense of place that develops over decades create genuine attraction for families seeking stability and community. While lacking the glamour of city centre living or the prestige of premium suburbs, Cadishead delivers practical advantages that families prioritise.

The transport connectivity, while not matching locations with direct Metrolink access, provides adequate links for car owning commuters. The M60 motorway accessibility enables connections throughout Greater Manchester, with Manchester city centre, Trafford, Salford Quays and other employment centres reachable within reasonable commuting times. For families where one or both adults work in Manchester but seek more affordable housing with better space provision, this connectivity proves sufficient.

The housing stock composition, predominantly semi detached and detached properties built across various decades, offers advantages in an era where families seek gardens and parking. Properties typically provide driveways accommodating multiple vehicles, gardens suitable for children and pets, and room sizes exceeding modern apartment standards. For families contemplating spending extended periods at home, whether through hybrid working arrangements or simply valuing domestic space, these features matter enormously.

The pricing accessibility remains perhaps the most compelling feature. In an era where homeownership feels increasingly challenging for younger generations, where London and southern prices prove prohibitive and even Manchester city centre stretches affordability, Cadishead delivers genuine accessibility. Properties achieving £190,000 to £250,000 represent realistic targets for first time buyers saving modest deposits and securing mortgages on combined household incomes that would prove inadequate in more expensive locations.

Strategic Perspectives for Buyers

For those considering purchasing property in Cadishead as we move into 2026, current market conditions deserve careful assessment. With stock levels normalising at healthy averages, transaction volumes running 9% above historical norms, and pricing showing strong appreciation, the market demonstrates functionality and genuine demand. Choice exists without overwhelming supply, sellers demonstrate realistic expectations, and completed transactions prove achievable for committed purchasers.

Yet Cadishead's market requires understanding of value within its context. Properties vary substantially in appeal based on street location, property type and condition. Detached homes on premium streets commanding £300,000 to £400,000 operate in different markets than terraced properties achieving £190,000 to £220,000, yet both serve genuine buyer needs and offer appropriate value within their segments.

Buyers should focus on understanding their priorities and matching them to available stock. First time buyers seeking maximum affordability might target terraced and smaller semi detached properties in the £190,000 to £230,000 range, accepting modest accommodation in exchange for homeownership accessibility. Growing families requiring more space might focus on larger semi detached and smaller detached homes in the £230,000 to £280,000 range, balancing space needs against budget constraints. Established families seeking premium accommodation might pursue larger detached homes exceeding £300,000, prioritising space, gardens and positioning over price minimisation.

The 9.3% growth in sales agreed asking prices, coupled with 4.6% growth in per square foot pricing, provides strategic guidance. Cadishead's market possesses genuine upward momentum that rewards buyers willing to commit. Properties priced realistically from launch tend to find buyers within reasonable timeframes, while those requiring dramatic reductions signal either initial overpricing or property specific issues requiring investigation.

Guidance for Sellers

If you're contemplating selling property in Cadishead in the coming months, the 2025 data delivers clear messages about strategy. The market will absorb quality property at sensible prices, demonstrated by the 9% above average sales agreed and the impressive price appreciation. Yet successful outcomes require realistic initial valuations, quality presentation and appropriate expectations about timeframes.

The 5.2% increase in asking prices year on year, the substantial declines in friction indicators, and the impressive 9.3% growth in achieved prices all underscore that the market functions well when properties launch at appropriate valuations. Premium properties in the best streets still achieve strong prices, but every segment requires realistic valuation based on genuine comparable evidence rather than optimistic hopes or outdated information.

The local agent you select carries importance. You need specialists understanding not just Greater Manchester's market broadly but Cadishead specifically. An agent recognising why certain streets command premiums over others, understanding buyer motivations and priorities, and providing honest evidence based valuation even when disappointing. Accurate valuations lead to completed sales while inflated ones lead to the price changes, withdrawals and extended marketing periods that previous years demonstrated prove counterproductive.

Presentation standards matter significantly. Buyers viewing multiple properties form rapid judgments about quality, condition and value. Every aspect influences these assessments, from kerb appeal through interior decoration, kitchen and bathroom condition, garden presentation, and overall sense of care and maintenance. In Cadishead's predominantly older housing stock, properties showing modernisation, good maintenance and quality presentation command premiums over those requiring immediate investment.

Looking Toward 2026

As we enter 2026, Cadishead's property market finds itself in an enviable position within Greater Manchester's residential landscape. The fundamental appeal of living in an affordable, family orientated community with Manchester connectivity remains intact and strengthening. What's evolved is the market's health, with friction indicators improving dramatically, pricing showing genuine appreciation, and transaction activity running above historical averages.

The months ahead will likely continue delivering modest but consistent growth. Greater Manchester's economic forecast, predicting 2.1% annual growth through 2028 and positioning as the second fastest growing economy nationally, creates employment and population expansion that supports housing demand. Salford's ongoing regeneration and profile enhancement benefits all areas within the borough. Broader recognition of commuter locations offering superior value to city centre equivalents drives buyer interest toward communities like Cadishead.

For buyers, particularly first time purchasers and families seeking value, Cadishead continues offering opportunities that few Greater Manchester locations can match. The ability to secure family sized accommodation with gardens at prices from £190,000 to £280,000, in a location providing Manchester accessibility, represents genuine accessibility in an era when homeownership feels increasingly challenging. Properties across various price points and types provide entry opportunities for buyers at different life stages and budget levels.

For sellers who engage pragmatically with current conditions, success remains highly achievable. Properties reflecting Cadishead's strengths, whether affordable terraced homes perfect for first time buyers, family sized semi detached properties appealing to growing families, or premium detached homes attracting established households, will find willing buyers when priced appropriately and presented exceptionally.

Cadishead's property market enters 2026 with confidence born of genuine health improvement and value appreciation. Stock levels normalised, friction indicators improved dramatically, pricing growing consistently, and transaction volumes running above historical averages all suggest a market operating efficiently and delivering value to participants. The community's transformation from overlooked commuter location to recognised value opportunity within Greater Manchester continues gathering momentum. Those who recognize Cadishead's unique combination of affordability, connectivity and family orientated housing stock will find that opportunities exist whether securing quality homes at fair prices or successfully transitioning to their next chapter by working with current market realities rather than yearning for conditions that no longer exist.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link