The Autumn Budget 2025

The much anticipated and later than usual Autumn Budget took place yesterday and after all the controversy of recent months surrounding potential tax reform, wronly paid stamp duty and failure to obtain the correct licence for renting out a home, you would surely think there couldn’t be anything else that could possibly go wrong.

Enter the OBR!

Following months of speculation, it was rather fitting that details of The Budget were leaked by the OBR an hour before Chancellor Rachel Reeves delivered her statement.

In what became an unprecedented breach, the fiscal watchdog inadvertently revealed two additional property taxes that would reshape parts of the UK housing market.

Here's what the second Budget since Labour came to power means for the property market.

‘Mansion Tax’

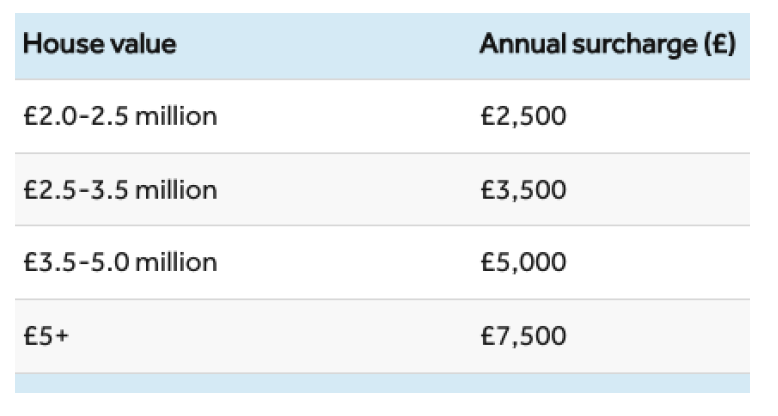

In what was a widely expected move, homes worth more than £2 million in 2026 will be subject to an annual surcharge from April 2028, officially termed the High Value Council Tax Surcharge.

The charge starts at £2,500 for properties over £2 million, rising to £7,500 for properties over £5 million, with the tax payable by the owner rather than the occupier.

Properties above the £2 million threshold will be placed into bands based on their property value, with charges increasing in line with CPI inflation each year from 2029/30 onwards. Buyers and sellers will continue to face uncertainty until the new scheme is introduced in April 2028, particularly around price thresholds. Even once valuations are completed, these could be challenged, prolonging the uncertainty even further. The mechanics of implementation present considerable challenges. Valuing properties that haven't sold for decades will trigger disputes and appeals, creating uncertainty and potentially dampening transaction activity.

Around 30% of properties in England have not changed hands since Land Registry records began in 1995, making comparables scarce. A revaluation every five years adds another dimension, as homes valued at £1.9 million today could well breach the threshold in subsequent cycles.

However, HM Treasury expects fewer than 1% of properties in England to be above the £2 million threshold. Knight Frank reports there are currently 150,000 properties worth in excess of £2 million in England and Wales, but estimates this will rise to 180,000 by 2028. Data from Rightmove shows that less than 0.5% of all home sales agreed this year have been for properties with an asking price over £2 million, and around 1% of homes for sale are priced above this threshold. Pre-Budget Anxiety Panic started to set in for homeowners throughout the country when Rachel Reeves left open the idea of higher property taxes at the Labour party conference on 29th September. In the months leading up to The Budget, rumours circulated about potential changes to property taxes. From stamp duty reforms to council tax overhauls and even a possible mansion tax, the uncertainty left many would-be movers wondering what it could mean for their finances. In a study of over 10,000 people who were either actively in the process of moving home or considering moving, 17% said they had paused their plans due to uncertainty about changes to property taxes, according to Rightmove. 61% of those surveyed said they were aware of rumoured property tax changes and 79% of this group said they were concerned about them. Unsurprisingly, those aged 55 and over were most likely to be concerned (81%), given the majority of rumoured tax reforms were targeted at homes at the higher end of the market.

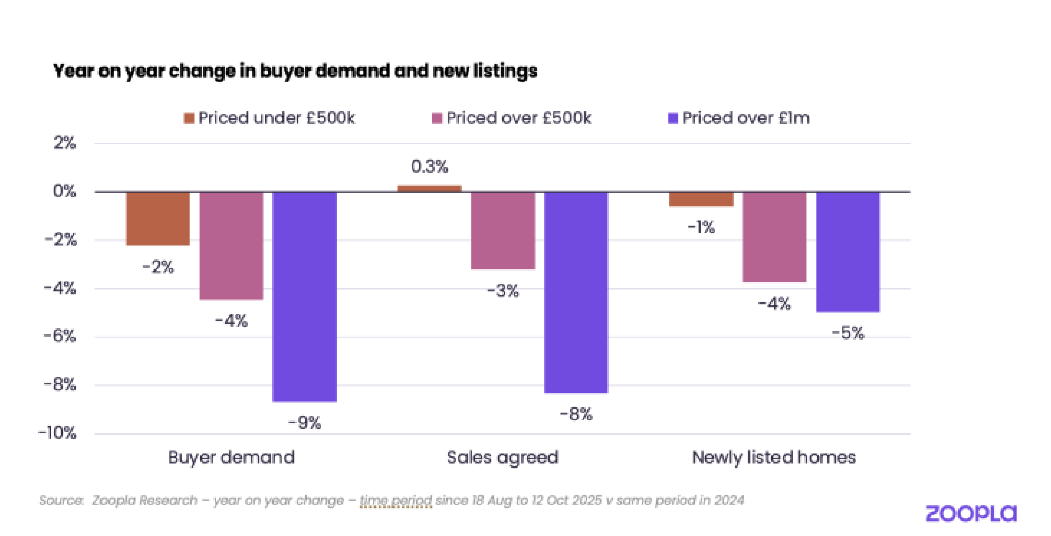

Sales agreed for homes worth more than £2 million were already down 13% year on year according to Rightmove, whilst Zoopla reported a drop in buyer demand, sales agreed and new listings above £1 million, suggesting the higher end of the market had already started reacting to potential changes ahead of The Budget.

Relief for the £500k+ Market

Relief for the £500k+ Market

The widely-speculated tax on homes over £500,000 has been avoided and should provide a boost to activity in this price sector, which accounts for approximately 25% of the market, following a drop in activity from both buyers and sellers in recent months according to both Rightmove and Zoopla.

Rightmove had reported homes between £500,000 and £2 million had seen sales agreed drop by 8% in the run up to The Budget, but Zoopla believe the confirmation that there will be no new annual tax on properties valued above £500,000 and the removal of uncertainty should bring relief to the owners of roughly 210,000 properties currently on the market above £500,000 as they expect buyer demand to strengthen as we head into 2026.

Income Tax On Rent

From April 2027, income tax on rental income for landlords will rise by 2%, with basic, higher and additional property income tax rates set to increase to 22%, 42% and 47% respectively.

This change will reduce profits for landlords. To offset these additional costs, some landlords will look to increase rents, whilst others may choose to exit the market, particularly smaller landlords who are already feeling the pinch from increased legislation, compliance, tax and higher interest rates.

The changes announced are not due to come into force until 2027 (landlord income tax changes) and 2028 (mansion tax), meaning any movers or homeowners affected have plenty of time to plan and assess what the changes might mean for them.

Market Reaction and Mortgage Rates

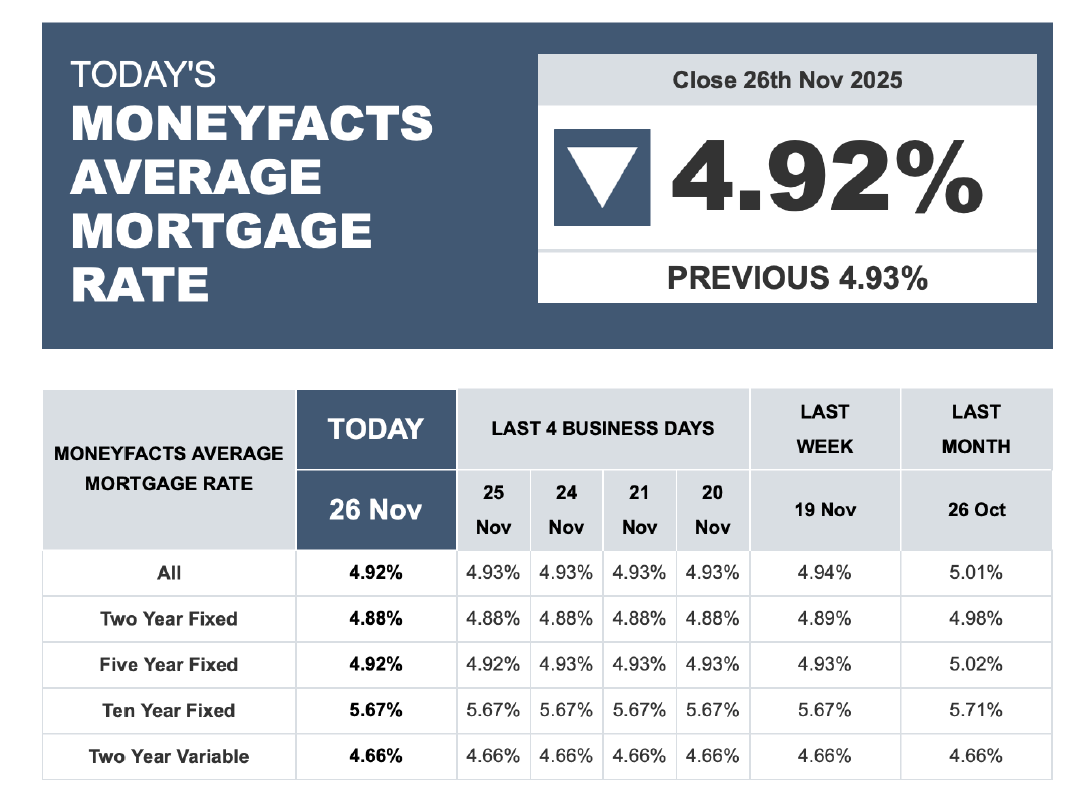

Gilt yields were largely unmoved following The Budget. Moneyfacts reported a slight drop in their average mortgage rate, though the markets were caught off guard by the OBR forecast being mistakenly released before the Chancellor's statement.

News of the higher headroom target initially saw gilt yields fall, with the 10 year rate down 8bps to 4.42%, but this then reversed fairly quickly and rose back up to 4.54%. The volatility continued with yields falling again to 4.45% yesterday afternoon.

However, the OBR is predicting that mortgage rates will rise from around 3.7% in 2024 to around 5% in 2029, 0.2 percentage points higher than its March forecast, which it said will "weigh on transactions."

OBR Forecasts The OBR expects the increase to property income tax rates from April 2027 to reduce house price growth by around 0.1 percentage points a year from 2028. The average house price in the UK is forecast to rise from £260,000 in 2024 to just under £305,000 in 2030, expected to grow by just under 3% in 2025 and average 2.5% from 2026. Property transactions are forecast to rise from just under 1.1 million in 2024 to around 1.3 million in 2029. This is around 155,000 fewer transactions a year than the OBR's March forecast by 2029. The OBR said: "Our lower forecast for property transactions over the medium term is because we have lowered our assumed turnover rate (the ratio of the total housing stock to housing transactions) to better reflect the impact of past increases in average stamp duty

OBR Forecasts The OBR expects the increase to property income tax rates from April 2027 to reduce house price growth by around 0.1 percentage points a year from 2028. The average house price in the UK is forecast to rise from £260,000 in 2024 to just under £305,000 in 2030, expected to grow by just under 3% in 2025 and average 2.5% from 2026. Property transactions are forecast to rise from just under 1.1 million in 2024 to around 1.3 million in 2029. This is around 155,000 fewer transactions a year than the OBR's March forecast by 2029. The OBR said: "Our lower forecast for property transactions over the medium term is because we have lowered our assumed turnover rate (the ratio of the total housing stock to housing transactions) to better reflect the impact of past increases in average stamp duty

The OBR forecasts that GDP will grow by 1.5% in 2025, above the 1% expected earlier this year. However, the outlook was downgraded from what the fiscal watchdog projected in March, with the economy now expected to expand by 1.4% in 2026 (below a previous forecast of 1.9%). GDP is estimated to expand by 1.6% in 2027 (against March's estimate of 1.8%), a 1.5% rise in 2028 (down from a predicted increase of 1.7% in March), and 1.5% in 2029 (not 1.8% as previously expected).

Conclusion

The council tax surcharge on homes over £2 million and the increase in property income tax will affect only a narrow slice of the market. For the mainstream, The Budget avoided disruption and delivered stability rather than shock, with no radical stamp duty overhaul and no new property tax regime. The removal of uncertainty is perhaps the most valuable outcome. The 17% of potential movers who paused their plans can now proceed with confidence, and the 210,000 properties above £500,000 currently on the market should see renewed interest. With implementation of the new measures not due until 2027 and 2028, affected buyers and landlords have ample time to plan.

For most of the market, this Budget was about what didn't happen rather than what did. No new taxes on the typical home. No stamp duty increases. No council tax revaluation. The feared changes that drove anxiety through the late summer and into the autumn simply never materialised. The OBR's forecasts point to steady, sustainable growth: house prices rising broadly in line with earnings, transaction volumes gradually recovering, and a market that continues to function. With mortgage rates showing early signs of stabilising and the Budget now behind us, the focus can shift back to fundamentals: employment, wages, and affordability. After months of speculation and uncertainty, the property market has the clarity it needed. For the overwhelming majority of buyers, sellers and homeowners, nothing has fundamentally changed, and that, in the current climate, is good news. The Budget is done, the uncertainty has lifted, and for 99% of the market, it's business as usual. That's a platform for renewed confidence heading into 2026. Now that clarity has arrived, normal service can hopefully resume.

#AutumnBudget2025 #UKHousingMarket #PropertyNews #RealEstateUK #MansionTax #Landlords #MortgageRates #HousePrices #PropertyInvesting #UKProperty #BudgetUpdate #HousingMarket

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link